(Reuters) – Alibaba Group beat third quarterly revenue estimates on Thursday, driven by e-commerce growth after China emerged from coronavirus lockdowns, and said it was assessing the suspension of its affiliate Ant Group’s listing.

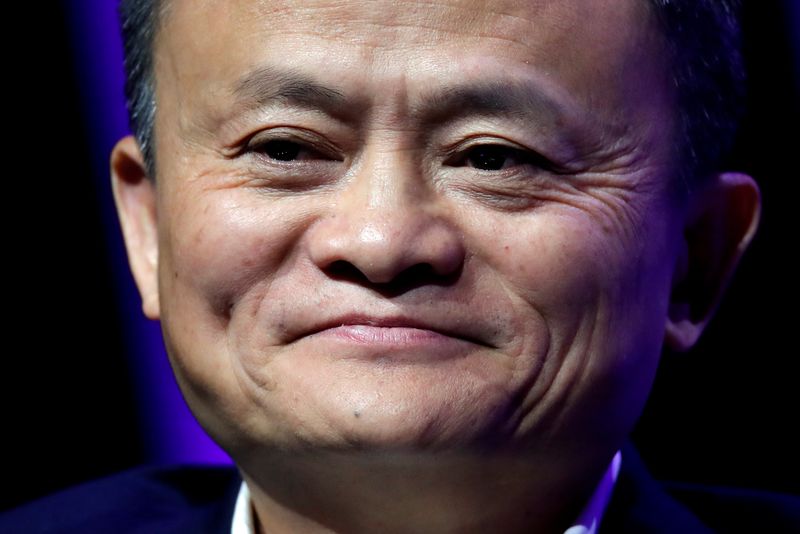

China’s surprise suspension of Ant Group’s planned $37 billion Shanghai initial public offering (IPO) was seen by some analysts and investors as an attempt by Beijing to cut founder Jack Ma and his financial services empire down to size.

Alibaba <6688.HK> Chief Executive Daniel Zhang said during an earnings call that added that Alibaba is “actively evaluating” the impact of the Ant Group IPO’s suspension on its business and will “take appropriate measures accordingly”.

Ant Group said separately it would decide whether to restart its IPO after fully reviewing and evaluating relevant measures.

Alibaba’s results also coincided with markets awaiting the outcome of the U.S. presidential election results, with Democrat Joe Biden edging closer to victory.

Under Donald Trump, the world’s top two economies have clashed over trade, forcing some Chinese companies to put off U.S. IPOs and list on exchanges close to home.

Revenue at Alibaba’s cloud computing business, a focus area for the company, jumped 60% to 14.9 billion yuan, while sales from its core e-commerce business rose 29% to 130.92 billion yuan in the reported quarter.

Net income fell 63% to 26.52 billion yuan, as Alibaba had booked a one-off gain last year from its 33% stake in Ant Group.

Revenue rose 30% to 155.06 billion yuan in the quarter ended Sept. 30, compared to estimates of 154.74 billion yuan, according to IBES data from Refinitiv.

Alibaba’s U.S.-listed shares <BABA.N> , which have gained about 39% this year, fell nearly 4% in trading before the bell.

(This story corrects to add dropped word “billion” in revenue estimates in paragraph 9; the error also occurred in earlier versions of the story)

(Reporting by Munsif Vengattil and Josh Horwitz; Editing by Shinjini Ganguli and Alexander Smith)