BERLIN (Reuters) – Germany has boomed on the back of globalisation, but now the worldwide web of supply chains that turbo-charged its economy could prove a critical weakness.

Shortages of semiconductors and other industrial components are threatening to derail the country’s economic recovery, forcing executives and policymakers to re-think supply lines and try to reduce reliance on a handful of Asian and U.S. suppliers.

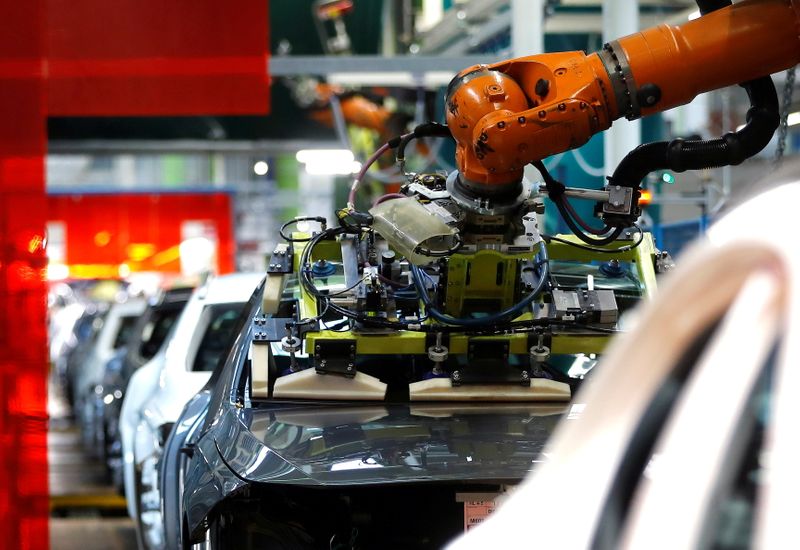

Automakers and electronics producers, in particular, are being hit hard by manufacturing delays of chips, caused by a global shortfall. This has become one of the biggest risks for Europe’s largest economy, on top of a third wave of COVID-19.

The Ifo economic institute warned this week that the supply bottlenecks had become more widespread. The outlook is most precarious for the manufacturing sector, which generates about a quarter of economic output and is driving growth.

“The situation is very tense,” said Eckehart Rotter, a spokesman for Germany’s VDA automobile association, adding that the semiconductor problems affected car manufacturers and suppliers alike.

Due to the shortages of electronic components, in particular the microcontroller chips crucial to modern vehicles’ functioning, production lines had to be stopped several times for several weeks due to delivery delays, Rotter said.

Volkswagen and Daimler are among the companies that have been affected in the auto sector, the driving force of German manufacturing. Industrial giant Siemens is also struggling to get enough semiconductors.

The problem has forced many companies to announce short-time work and scale back production for the coming weeks, with the scarcity of components also expected to lead to higher end-prices for consumers and overall inflationary pressures.

The production cuts suggest that passenger car production in Europe will miss forecasts in the first half of the year.

“This affects highly integrated microprocessors as well as simple control elements,” the VDA’s Rotter said, adding that more than 1,000 of such components are needed in some vehicles.

“The extent to which this deficit can be made up in the second half of 2021 is currently still open. The situation remains critical.”

SEMICONDUCTOR ‘SOVEREIGNTY’

The global chip shortage stems from a combination of factors including fallout from last year’s COVID-19 shutdowns and factories struggling to meet demand for semiconductors which have become omnipresent in an increasingly digitised world.

Automakers and suppliers rely almost exclusively on chips from a few manufacturers, so-called foundries. They include Taiwan Semiconductor Manufacturing Co (TSMC), South Korea’s Samsung Electronics Co Ltd, GlobalFoundries, United Microelectronics Corp and SMIC whose production sites are located mainly in Taiwan, South Korea, China and the USA.

“There is hardly any other economy which has benefited as much from globalisation in recent years as Germany,” said Iris Ploeger, a board member of the BDI industry association. But she acknowledged the chip shortages had exposed this reliance on overseas suppliers as an Achilles’ heel of Deutschland AG.

While VDA and BDI are not questioning the importance of free trade and open markets, both call on companies to address the downside risks of globalisation and diversify supply chains.

And this means bringing back factories to Germany or at least to the European Union’s single market, they say.

“When it comes to chip design, Europe is dangerously dependent on other regions,” Ploeger said, adding European industry had to regain lost skills with government support.

“European sovereignty for semiconductors is important in order to be able to react more flexibly to disruptions in supply chains and to changes in consumption patterns.”

CHIP SHORTAGES INTO 2022?

Since global semiconductor production capacities are fully utilized, a significant short-term expansion of production is not on the cards and some analysts forecasts the shortages could last into next year.

“In the medium to long term, it’s also in Europe’s interest to increasingly localize these technologies in Europe,” the VDA’s Rotter said. “But that takes time and does not solve the current bottleneck problem.”

Further complicating the economics of such re-locating steps is the problem that the German car industry’s share in the global semiconductor market itself is too small for a complete and profitable in-house production, he added.

In alliance with the European Union’s executive, German Economy Minister Peter Altmaier and French counterpart Bruno Le Maire are planning to pour billions of euros into state aid schemes to support the construction of local chip factories and development of next-generation semiconductors.

As parts of the efforts, the European Commission last month launched a 10-year plan, setting its sights on a 20% global semiconductor market share and building a fabrication plant that can make superfast 2 nanometer chips.

On Friday, European Commission Thierry Breton will meet the chief executive of chipmaker Intel and a top executive of Taiwanese competitor TSMC as the EU seeks to shield the bloc from future shocks in the global supply chain.

Breton is seeking to persuade a leading chipmaker to site a major fabrication plant in the EU that would help realise the Commission’s strategic goal of securing the most advanced chip production technology over the next decade.

(Reporting by Michael Nienaber; additional reporting by Rene Wagner; editing by Mark John and Pravin Char)