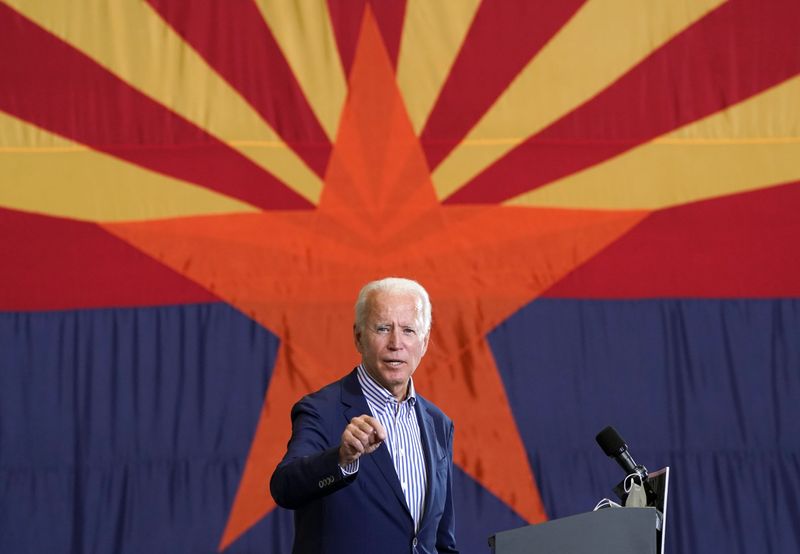

WASHINGTON (Reuters) – Joe Biden will reverse Republican tax cuts for the wealthy and corporations on “day one” if he wins November’s election, his Democratic running mate, Senator Kamala Harris, vowed during Wednesday night’s vice-presidential debate.

Other Democrats in Washington, however, say that timing looks overly ambitious. A new Biden administration, which would be inaugurated on Jan. 20, 2021, would likely face a still-raging coronavirus pandemic and an economy deep in recession.

His first step on taxes could be a more straightforward one, say some Democrats, including Biden advisers: beefing up Internal Revenue Service (IRS) enforcement to go after wealthy tax cheats who cost the United States hundreds of billions of dollars in revenue every year.

Tackling major tax reform, and particularly repealing the 2017 Tax Cuts and Jobs act, a signature Trump policy that reduced corporate taxes, depends on multiple factors, said Jared Bernstein, Biden’s chief economist as vice president, who now serves as an external adviser to his campaign.

“I don’t think there’s any way to zero in on the timing at this point,” he said in an interview days before the vice presidential debate. “There’s a lot that has to be dealt with between now and then, including winning,” said Bernstein.

He and other prominent Democrats, however, are happy to talk in detail about what they say is a need for much stronger enforcement at the IRS, which has suffered a decade of budget cuts and hiring freezes imposed by Republicans in Congress.

Bernstein said Biden would seek “significant increases in IRS enforcement and auditing, particularly for those with complex business structures” like Trump.

Senator Maggie Hassan, a senior Democrat on the tax-writing Senate Finance Committee, said at a subcommittee hearing on Wednesday that her top fiscal priority was new coronavirus aid to households and businesses, followed by shrinking the “so-called tax gap, which comes from corporations and billionaires avoiding taxes by under-reporting income to the Treasury.”

‘STUPID’ TAXPAYERS

After a Democratic primary that featured heated debate over a progressive wealth tax, Biden and his advisers have emphasized tax “fairness” over tax code details.

His tax plan would repeal elements of the 2017 Republican tax act, raising rates to 39.6% for Americans with income above $400,000, and capital gains tax rates for those with income above $1 million. The corporate tax rate would rise to 28% from the current 21%.

Biden’s proposal to reduce a $11.6 million estate tax exclusion has already set off a scramble among wealthy Americans to revise their estate planning before year-end.

A New York Times report last week that President Donald Trump paid just $750 in taxes in 2016 and 2017, and nothing for years before then, has put the spotlight back on who pays what.

Trump said during the presidential debate last week that he paid “millions of dollars” in taxes during the years in question, but also took deductions to which he was entitled as a real estate developer.

“Like every other private person, unless they’re stupid, they go through the laws and that’s what it is,” Trump said.

The Trump tax disclosures are “clarifying for our side of this debate about what the tax code should look like and how you should reform it based on fairness,” a Senate Democratic aide said. “It’s a question of wages versus wealth.”

Still, lawmakers would have to have “very complicated conversations” to sort out how to proceed, the aide said.

A $441 BILLION TAX GAP

Individual tax returns fuel the U.S. government’s $4 trillion-plus budget.

Individuals who report large business losses but no revenues pose a “significant compliance risk” that is contributing to a $441 billion annual tax gap – the difference between taxes owed and taxes collected, the U.S. Treasury Inspector General for Tax Administration said in a Sept. 28 audit report.

It said the IRS should audit people showing $100,000 or more in business losses and no receipts, a recommendation the IRS declined, saying it would require “diversion of resources from other areas.”

An IRS spokesman did not immediately respond to a request for comment.

Reforming tax compliance is also complicated.

Former president Barack Obama’s creation of a ‘wealth squad’ within the IRS to audit the rich drew the ire of Republicans in Congress, who responded by slashing the IRS enforcement budget, which reduced tax agents, over the next decade.

Now, the agency’s enforcement capability is at a “crisis point” and rebuilding it would require a massive investment in technology, hiring and training thousands of new agents, said Robert Gardner, who worked for the IRS for 39 years, and left in 2013.

“More IRS agents intruding into people’s lives is never a politically popular move,” added Gardner, now a consultant on tax whistleblower cases.

However, nearly two-thirds of Americans think the wealthy should pay an extra share of taxes, a Reuters/Ipsos poll this January found.

The IRS enforcement cuts have acted effectively as “shadow tax cuts targeted at high end avoiders and evaders,” said Bernstein. “The Democrats I speak to are not at all happy about that.”

(Reporting by David Lawder; Editing by Heather Timmons and Rosalba O’Brien)