By Jessica Toonkel

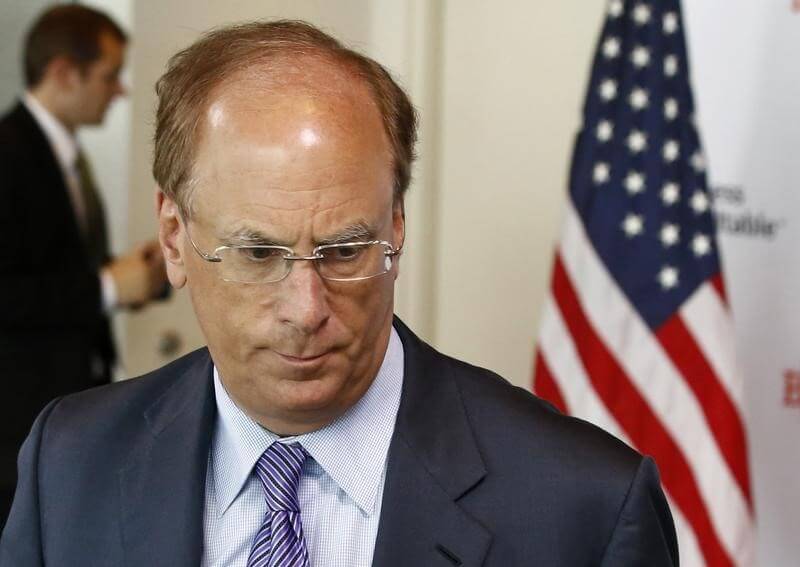

(Reuters) – BlackRock Inc’s chief executive officer Larry Fink said on Thursday that he is bullish on European equities and believes that Europe’s GDP will beat that of the U.S. in the first quarter. “Europe is going to be the surprise for the year,” he said on CNBC.

Fink said the lower valuation of the euro has given European companies a big competitive advantage over their U.S.-based counterparts. That along with low oil prices and a more stable European banking system means that European equities are poised to outperform U.S. equities, he said. “I like European and Asian equities more than U.S. equities,” he said.

Given the three-year run that U.S. equities have had, “it’s catch up time,” he said.

Already, Fink has seen clients pouring into its European equity funds as investors look for yield in the low interest rate environment, he said.

Low interest rates in Europe are “truly harming” European pension funds and insurance companies, he said.

“This is one of the areas where I don’t believe that central banks appreciate what negative rates do,” he said.

Going forward, Fink believes oil prices will stay between $60 to $80 per barrel as there continues to be more supply pressure than demand.

Fink also discussed his recent letter to the CEOs of the 500 largest publicly listed U.S. companies urging them to resist short-term activists.

Fink said that not all activists are short-term and noted that BlackRock has voted with activists about 55 percent of the time.

(Reporting By Jessica Toonkel; Editing by Chizu Nomiyama)

BlackRock’s Fink favors equities in Europe over U.S.: CNBC

By Jessica Toonkel