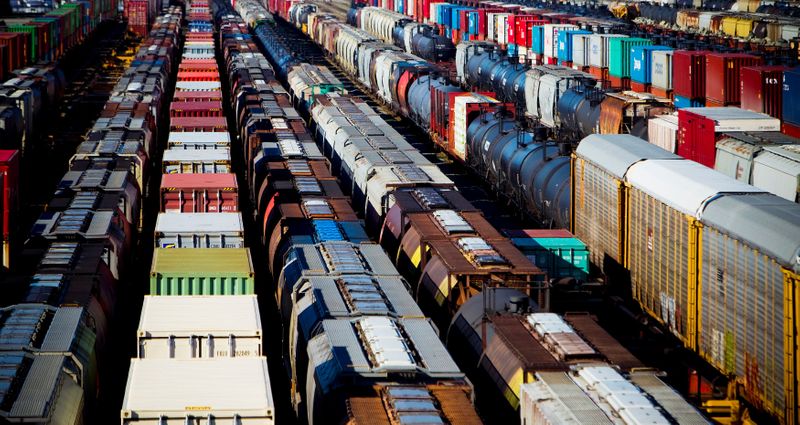

(Reuters) – Canadian Pacific’s $25 billion deal to buy Kansas City Southern will create a rail network from Canada to Mexico that farm groups say could smooth the flow of their goods to market.

The deal, subject to approval by the U.S. Surface Transportation Board, would combine CP’s cross-Canada network, which stretches as far south as Kansas City, Missouri, with its U.S. rival’s network, which extends south into Mexico.

Mike Steenhoek, executive director of the Iowa-based Soy Transportation Coalition said the deal could increase market access for customers of each railway.

“Many current Canadian Pacific customers currently only have access to export terminals in the Pacific Northwest,” Steenhoek said in a statement. “Similarly, current Kansas City Southern customers may enjoy new access to markets served by the Canadian Pacific network.”

Mexico is a major buyer of U.S. corn and Canadian canola.

“This will open up a whole new set of opportunities for grain shipments,” said an industry source close to the deal.

Canadian grain handlers also see potential for enhanced sales, but are awaiting details on how much of a priority the combined company will place on customer service, said Wade Sobkowich, executive director of the Western Grain Elevator Association, whose members include Cargill Ltd and Richardson International.

CP has effectively moved Canadian grain in the past year, but its spending on upgrading its network has lagged the agriculture sector’s growth during the past five years, Sobkowich said.

For Canadian oil, the merger may offer modest benefits for producers who ship with CP, said John Zahary, chief executive of Altex Energy, which operates rail uploading terminals connected to Canadian National, which handles more oil volumes.

The combination is likely to increase industry price competition and is thus unlikely to face regulatory roadblocks, analysts said.

“This is by default negative for the other railroads, including Canadian National, which faces a longer haul competitor into the Gulf Coast and Midwest,” J.P. Morgan analyst Brian Ossenbeck said in a research note.

DBRS Morningstar raised concern, however, about CP’s growing debtload after the deal, placing the company’s credit ratings under review.

CP plans to return to its pre-acquisition debt to EBITDA leverage target, but not until at least 2023, the ratings agency said.

Kansas City shares jumped 11% to $249.09 but were still well short of the offer price of $275, a move that analysts attributed to the extended lead time for the deal, which is not expected to close until the middle of 2022.

Shares of Canadian Pacific fell about 5%.

CP Chief Executive Keith Creel approached Kansas City Southern CEO Pat Ottensmeyer late last year to discuss a deal, the industry source said, adding that the two executives know each other well.

While it is the biggest M&A deal announced thus far in 2021 and is the largest ever involving two rail companies, it ranks behind the 2010 takeover of BNSF by Warren Buffett’s Berkshire Hathaway for $26.4 billion.

The cash-and-stock offer has an enterprise value of about $29 billion, implying an 18 times multiple to Kansas City’s 2021 earnings before interest, taxes, depreciation, and amortization (EBITDA) estimate, according to analysts.

That is higher than Kansas City’s current multiple of 14 times, making any competing bids unlikely, Ossenbeck said.

(Reporting by Ankit Ajmera and Sanjana Shivdas in Bengaluru, Rod Nickel in Winnipeg, Allison Lampert in Montreal and Maiya Keidan and Fergal Smith in Toronto; Editing by Christian Plumb, Anil D’Silva, Jonathan Oatis and Richard Pullin)