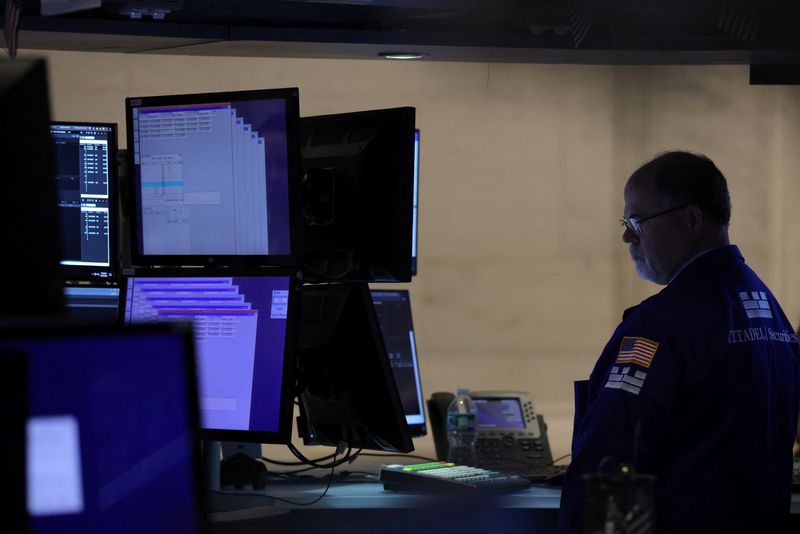

LONDON (Reuters) – One of the worst starts to a year in decades might lead you to think investors are already braced for an economic storm ahead, but it’s far from clear recession risks have been taken on board or are fully priced.

Reasons for this year’s 15-20% slide in benchmark stock indices are well documented – rising interest rates to rein in soaring post-pandemic inflation rates that have been exaggerated by a Ukraine-related energy and food price shock that has also pummelled household incomes and corporate margins.

Throw in heightened geopolitical risks more generally, China’s growth-sapping “zero COVID” lockdowns, persistent supply-chain problems and chip shortages – and skies darken further. And while a Northern summer might alleviate the immediate energy pressure, there’s little clarity in Europe about what happens coming next winter if Russian gas supplies are cut off.

No great surprise then that economists are warning of a global recession ahead even as many parts of the world appeared to be just surfing the crest of a post-pandemic reopening wave.

The main policy debate hinges on whether the U.S. Federal Reserve and other central banks will feel the need to tighten monetary policy to “restrictive” territory that deliberately slows economies to drag inflation back down – or whether growth will roll over before they even need to consider getting above so called “neutral” rates still 150 basis points up from here.

Either way, it’s not a great picture of activity ahead.

Just this week World Bank President David Malpass feared the worst for global output. “It’s hard right now to see how we avoid a recession,” he said on Wednesday.

Washington’s Institute for International Finance halved its world growth forecast to just 2.3% for this year and said “global recession risk is elevated”.

Commercial banks such as Deutsche Bank and Wells Fargo now forecast a U.S. recession at some point over the next 12-18 months, while many houses see Europe there this year.

Economic data surprises are turning sour, with U.S. and China indexes rolling over again and now more negative than they’ve been seen the Omicron variant first hit six months ago. And this time with world oil prices 50% higher than they were last Autumn and, at almost 3%, 10-year dollar borrowing rates more than twice November levels.

And U.S. housing markets are beginning to creak under the weight of rising mortgage rates and searing materials costs.

So, on many levels, the outsize drop in stock prices is more than well founded – the only question is whether it’s enough.

Graphic: Econ Surprise Indexes turn back negative – https://fingfx.thomsonreuters.com/gfx/mkt/byprjdergpe/One.PNG

Graphic: World stocks forward PE valuations – https://fingfx.thomsonreuters.com/gfx/mkt/klvykobdgvg/Four.PNG

ANOTHER LEG LOWER?

With interest rate-sensitive technology stocks taking the brunt of the hit and the Nasdaq index down 25% year-to-date, the temptation is to think a lot is already on board.

Standard valuations that look at prices as a ratio of 12-month forward earnings show 25-30% plunges in the United States and Europe since January and might typically suggest a bargain or two.

The problem is there’s been little or no downgrade of aggregate 12-month forward or full-year 2023 earnings forecasts yet despite darkening outlooks from many tech, digital and subscription-based firms as well as those exposed to China and chip shortages – or indeed energy rationing in Europe.

And even though we’ve seen a cheapening of the most expensive Wall St stock valuations since the dot.com bubble 20 years ago, they are still above 30-year averages and only back to where they were on the eve of the pandemic. The picture is slightly better in Europe, though not much.

But unfazed earnings projections are perhaps the most alarming aspect of current valuations.

After all the shocks and interest rate rises since January, aggregate full-year earnings growth forecasts for the S&P500 have actually increased by more than a percentage point and 2023 projections have barely budged at just under 10%.

Many fear there’s a very heavy shoe waiting to drop here if recession fears are realised. And if earnings forecasts are revised lower over the coming months and through the second-quarter earnings season, do stocks just become more expensive again or will prices have to be discounted further?

“The question is: will the equity market go ahead and discount the earnings cuts we think are coming or will it require companies to formally cut guidance?” Morgan Stanley’s strategists mused this month, adding “bear market rallies” are likely but another 15-20% leg lower for the S&P500 is then likely.

That’s still a minority view, however.

JPMorgan’s team still insist the “risk-reward” is positive for equities in the medium term, pointing to a bottoming in China, a Fed pivot away from relentless tightening and a peaking dollar as reasons to think the worst is over for markets.

And while many asset managers – such as Blackrock this week – seem to think the fabled “soft landing” is still ultimately possible, they are keen to stay neutral on equities while it plays out.

Stefan Kreuzkamp, DWS Chief Investment Officer, remains upbeat on stocks despite this year’s shocking start.

But he adds a fairly basic get-out clause — “the precondition that risks do not escalate – no recession in the United States and Europe – and that the U.S. central bank manages to contain inflation without curtailing economic growth too much.”

That may be a nervy wait.

Graphic: Earnings forecasts for 2022 and 2023 in Europe and US – https://fingfx.thomsonreuters.com/gfx/mkt/egvbkwqakpq/Three.PNG

Graphic: Forward PEs for US and Europe – https://fingfx.thomsonreuters.com/gfx/mkt/lbpgndzoqvq/Two.PNG

The author is editor-at-large for finance and markets at Reuters News. Any views expressed here are his own

(by Mike Dolan, Twitter: @reutersMikeD. Charts by Danilo Masoni; editing by David Evans)