NEW YORK (Reuters) – The dollar hit a two-week high on Tuesday, as risk appetite faded amid a sell-off in stocks, with U.S. Treasury Secretary Janet Yellen’s comments saying interest rates may need to rise to prevent the American economy from overheating also supporting the greenback.

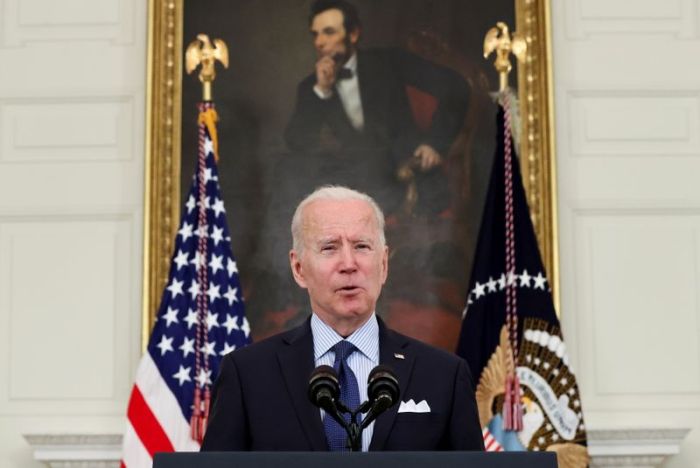

Yellen, in prepared remarks on Tuesday, made the comment as more of U.S. President Joe Biden’s economic investment programs come on line. She did say that the additional spending was small compared to the relative size of the economy.

The dollar’s safe-haven appeal received a further boost as the Nasdaq fell more than 2%, the S&P more than 1% and the Dow Jones Industrial Average a less steep 0.3% , and as Treasury yields declined. [.N][US/]

Analysts said much of the good news on the economy has likely been priced in by the market.

“After improving dramatically through the first quarter, U.S. economic expectations have converged with reality, meaning that surprises are no longer skewed toward the positive,” said Karl Schamotta, chief market strategist at Cambridge Global Payments in Toronto.

“For many investors and momentum traders, some rebalancing, away from risk-sensitive currencies and toward havens, is making a lot of sense at this juncture,” he added.

Tuesday’s bounce reversed losses sustained on Monday after a disappointing U.S. manufacturing survey report, leaving the dollar 1% above a one-month low struck last week.

The dollar index, which measures the dollar’s value against a basket of other major currencies, climbed 0.3% to 91.278. It fell more than 2% in April.

“There is no consensus right now on what will happen to the dollar for the rest of the year, as there was at the start,” Tempus Inc said in its latest research note.

“While some traders see the U.S. dollar with room to grow because of bond yields going higher in the future as inflation expectations grow, others believe the buck is now overvalued and will only keep dwindling as the rest of the world successfully plays catch-up.”

Graphic: USD positions – https://fingfx.thomsonreuters.com/gfx/mkt/bdwvkwggovm/USD%20positions.JPG

The U.S. dollar gained 0.8% against the Australian dollar to US$0.7704 and 0.9% versus the New Zealand dollar to US$0.7138, even though commodity prices were generally firmer across the board.

The euro fell 0.4% against the dollar to $1.2013. Against the yen, the dollar rose 0.2% to 109.32 yen.

Sterling dipped 0.1% to $1.3881 ahead of a Bank of England meeting on Thursday, which may announce a slowdown in its bond buying program as the vaccine rollout bolsters Britain’s economy.

In the cryptocurrency sector, ethereum powered to another record peak of $3,530 on Tuesday, amid increasing institutional interest. It was last down 1.7% at $3,370.

Dogecoin, created as a joke for early crypto adopters, hit an all-time high of US$0.5922. It was last up 36% at US$0.5549, according to CoinGecko.com.

(Reporting by Gertrude Chavez-Dreyfuss: Editing by Jonathan Oatis and Alistair Bell)