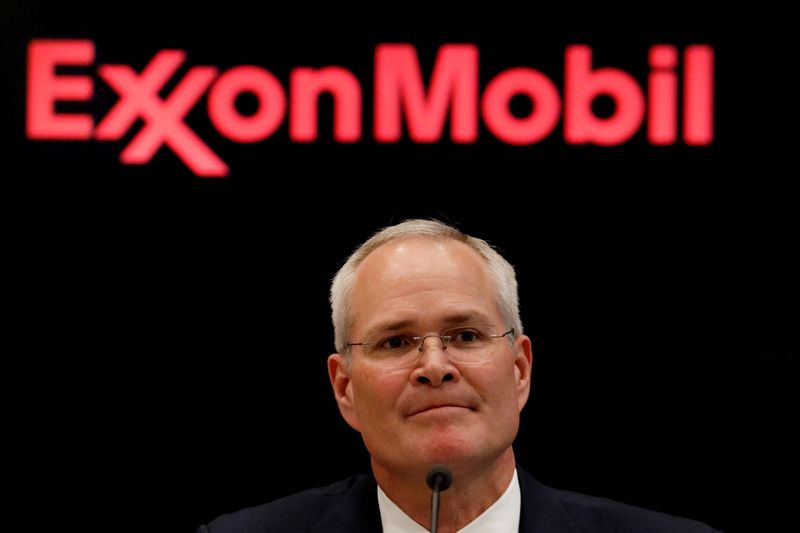

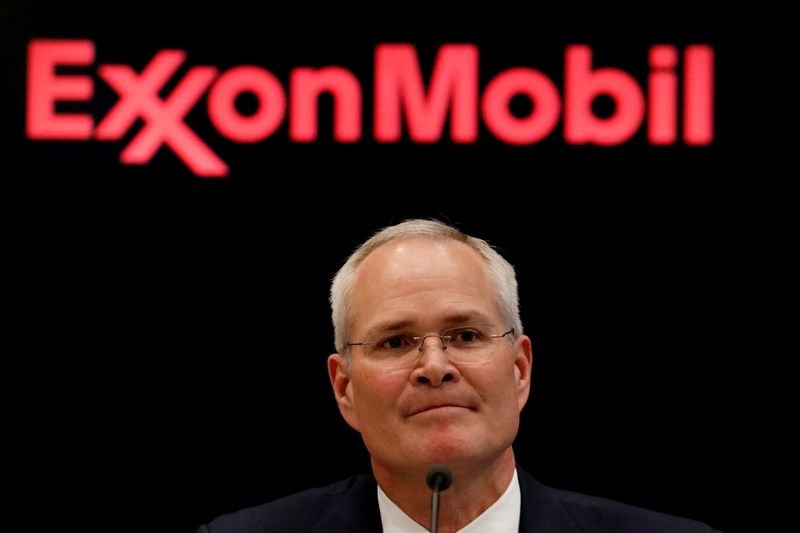

HOUSTON (Reuters) – New York state’s pension fund on Friday threw its support behind an activist fund’s slate of nominees to Exxon Mobil Corp’s board, heating up a proxy fight for the company’s future.

The biggest U.S. oil producer Exxon and activist hedge fund Engine No. 1 are battling over board seats following Exxon’s historic net annual loss of $22.4 billion for 2020. The fund has criticized the producer for “significant underperformance” and a lagging approach to cleaner fuels.

The Exxon board “needs an overhaul,” to better manage climate risks and guide the company to a low carbon future, said N.Y. State Comptroller Thomas DiNapoli.

The activist fund nominees include Gregory Goff and Anders Runevad, former chief executives of oil refiner Andeavor and wind-turbine manufacturer Vestas Wind Systems, respectively; Kaisa Hietala, former head of renewable fuels at Finish refiner Neste; and former U.S. Assistant Secretary of Energy for efficiency and renewable energy, Alexander Karsner.

“We are excited to have a new slate of candidates to support,” DiNapoli said. “We are supporting Engine No 1’s slate of candidates because they bring transformative industry experience to the table and hold out hope that it is not too late to turn the tide at Exxon and improve its performance.”

Exxon and Engine No. 1 did not respond to requests for comment.

Engine No. 1 also has won support from California State Teachers’ Retirement System (CalSTRS), the second largest U.S. pension fund. Hedge fund D.E. Shaw plans to vote with the company, according to people familiar with the matter.

New York state pension funds overseen by DiNapoli also will vote in favor of existing Exxon board members Kenneth Frazier and Ursula Burns and two of three board members Exxon has added in recent months, activist investor Jeffrey Ubben and former Comcast executive Michael Angelakis, but will withhold votes on the remaining directors, it said.

It is not in favor of oil executive Tan Sri Wan Zulkiflee Wan Ariffin, a former CEO of Malaysian state energy firm Petronas, who Exxon also named to the board this year.

The funds hold 8.14 million shares of Exxon, according to Refinitiv. The fund has previously led shareholder proposals calling on Exxon to detail how its business could be affected by climate change. It also has supported proposals to split the CEO and chairman’s roles at the oil producer.

Other votes this year will include favoring an independent board chair again, additional climate lobbying disclosures and a report on how Exxon’s finances and business assumptions would be impacted by net zero scenarios.

The fight for board seats is costing Exxon at least $35 million more than its typical proxy solicitation costs, with the largest U.S. oil producer marshalling executives, TV appearances, social media and websites to rebut the challenge, according to regulatory filings.

Engine No. 1 has a $30 million budget for the fight, according to regulatory filings.

Exxon is also urging shareholders to reject proposals to split its chairman and CEO roles, and block climate-related reports sought by other groups.

To blunt investor criticism, in recent months it has expanded its board, pledged to increase low-carbon initiatives, improved climate disclosures and said it would lower the intensity of its oilfield greenhouse gas emissions.

The virtual shareholder meeting is May 26.

(Reporting by Jennifer Hiller and Gary McWilliams; Editing by Marguerita Choy)