HONG KONG (Reuters) – China Evergrande Group has supplied funds to pay interest on a dollar bond, a person with direct knowledge of the matter told Reuters on Friday, days before a deadline that would have seen the developer plunge into formal default.

News of the remittance will likely bring relief to investors and regulators worried about a default’s wider fallout in global markets, adding to reassurance from Chinese officials who have said creditors’ interests would be protected.

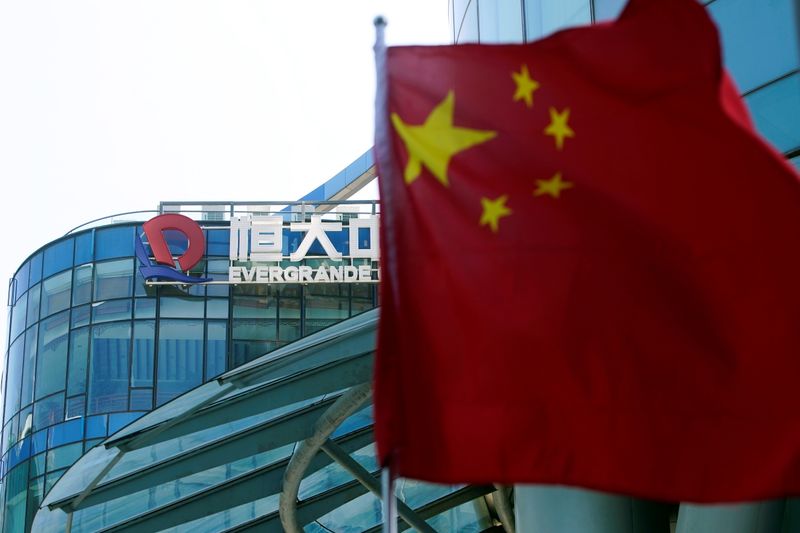

WHAT IS EVERGRANDE?

Chairman Hui Ka Yan founded Evergrande in Guangzhou in 1996. It is China’s second-largest property developer, with $110 billion in sales last year, $355 billion in assets and more than 1,300 developments nationwide. It listed in Hong Kong in 2009.

Evergrande grew rapidly through a loan-supported land-buying spree and selling apartments quickly at low margins. It employed 163,119 staff as of June-end, its interim report showed.

Slowing growth has seen it branch into businesses such as insurance, bottled water, soccer and electric vehicles (EVs).

HOW DID CONCERNS ARISE OVER DEBT?

In September last year, a leaked letter showed Evergrande pleading for government support to approve a now-dropped backdoor stock market listing. Sources told Reuters the letter was authentic; Evergrande called it fake.

In June, Evergrande said it did not pay some commercial paper on time, and in July a court froze a $20 million bank deposit held by the firm at the bank’s request.

The firm in late August said construction at some of its developments had halted due to missed payments to contractors and suppliers. It sought repayment extension for a trust loan in early September, sources told Reuters, and media reports said Evergrande would suspend interest payments due on loans to two banks that month.

Liabilities, including payables, totalled 1.97 trillion yuan ($306 billion) at end-June – equivalent to 2% of China’s gross domestic product.

HOW HAS EVERGRANDE REDUCED DEBT?

Evergrande accelerated efforts to cut debt last year after regulators introduced caps on three debt ratios, dubbed the “three red lines”. It has been aiming to meet those requirements by the end of 2022.

It offered steep discounts on residential developments to spur sales and sold the bulk of its commercial properties. Since the second half of 2020, it has had a $555 million secondary share sale and raised $1.8 billion by listing its property management unit, while its EV unit told a $3.4 billion stake.

On Sept. 14, it said asset and equity disposal plans had failed to make material progress.

WHAT’S THE RISK?

China’s central bank said in 2018 companies including Evergrande might pose systemic risk to China’s financial system.

The firm’s liabilities involved as many as 128 banks and over 121 non-banking institutions, the leaked letter showed.

Late repayments could trigger cross-defaults as many financial institutions are exposed via direct loans and indirect holdings through different financial instruments.

OPERATIONS OUTSIDE MAINLAND CHINA?

In Hong Kong, Evergrande owns an office tower and residential development as well as two nearly completed residential developments, plus a vast undeveloped land parcel.

It has spent billions of dollars acquiring stakes in automobile technology developers, including Sweden’s NEVS, the Netherlands’ e-Traction and Britain’s Protean. It also has joint ventures with Germany’s Hofer and Sweden’s Koenigsegg.

WHAT DO REGULATORS SAY ABOUT EVERGRANDE, PROPERTY?In comments reported by state media Xinhua and echoing words from the central bank, Vice Premier Liu He told a Beijing forum on Wednesday that the risks were controllable and that reasonable capital demand from property firms was being met.

The chairman of China’s securities regulator, Yi Huiman, said the authorities would properly handle the default risks and look to curb excessive debt more broadly.

Central bank Governor Yi Gang said on Sunday the world’s second-largest economy is “doing well” but faces challenges such as default risks for certain firms due to “mismanagement.”

Yi said China will fully respect and protect the legal rights of Evergrande’s creditors and asset owners, in line with “repayment priorities” laid out by China’s laws.

WHAT’S NEXT FOR EVERGRANDE?

Evergrande remitted $83.5 million to a trustee account at Citibank on Thursday, the source told Reuters, allowing it to pay all bondholders before the payment grace period ends on Saturday.

Still, the developer will need to make payments on a string of other bonds, with the next major deadline to avoid default only a week away and little known about whether it is in a position to pay those debts.

Evergrande missed coupon payments totalling nearly $280 million on its dollar bonds on Sept. 23, Sept. 29 and Oct. 11, beginning 30-day grace periods for each.

After a grace period ends, non-payment would result in formal default and trigger cross-default provisions for its other dollar bonds. Evergrande’s next payment deadline is Oct. 29, with the expiration of the 30-day grace period on its Sept. 29 coupon.

(Reporting by Clare Jim; Editing by Sumeet Chatterjee, Christopher Cushing and William Mallard)