(Reuters) – The U.S. Federal Reserve on Wednesday released thousands of letters and emails from individuals, businesses and nonprofit groups this spring urging wider access to its Main Street Lending Program for Americans slammed financially during the pandemic.

The central bank announced the Main Street program in late March, offering loans to mostly medium-sized businesses with up to 15,000 employees or revenues up to $5 billion.

It asked for public feedback and got plenty. Correspondence poured in from a diverse cross-section of Americans reeling economically and in need of funds to tide them over. The Fed incorporated some of the suggestions into the planned program, which launched in mid-June but had yet to make a loan as of last week.

There were earnest pleas to make funds available to organizations that had originally been excluded. There were also glib requests for the Fed to just send money.

“Print me out $200,000,000,000,000.00 ($200 trillion),” wrote one correspondent whose name was withheld.

The writers included school-meal providers, the American Hospital Association, a tuxedo rental company, the U.S. Olympic & Paralympic Committee, local YMCAs and the California State University system. Requests also came from energy providers, Dallas hotel magnate Monty Bennett, and advocates for the needs of felons.

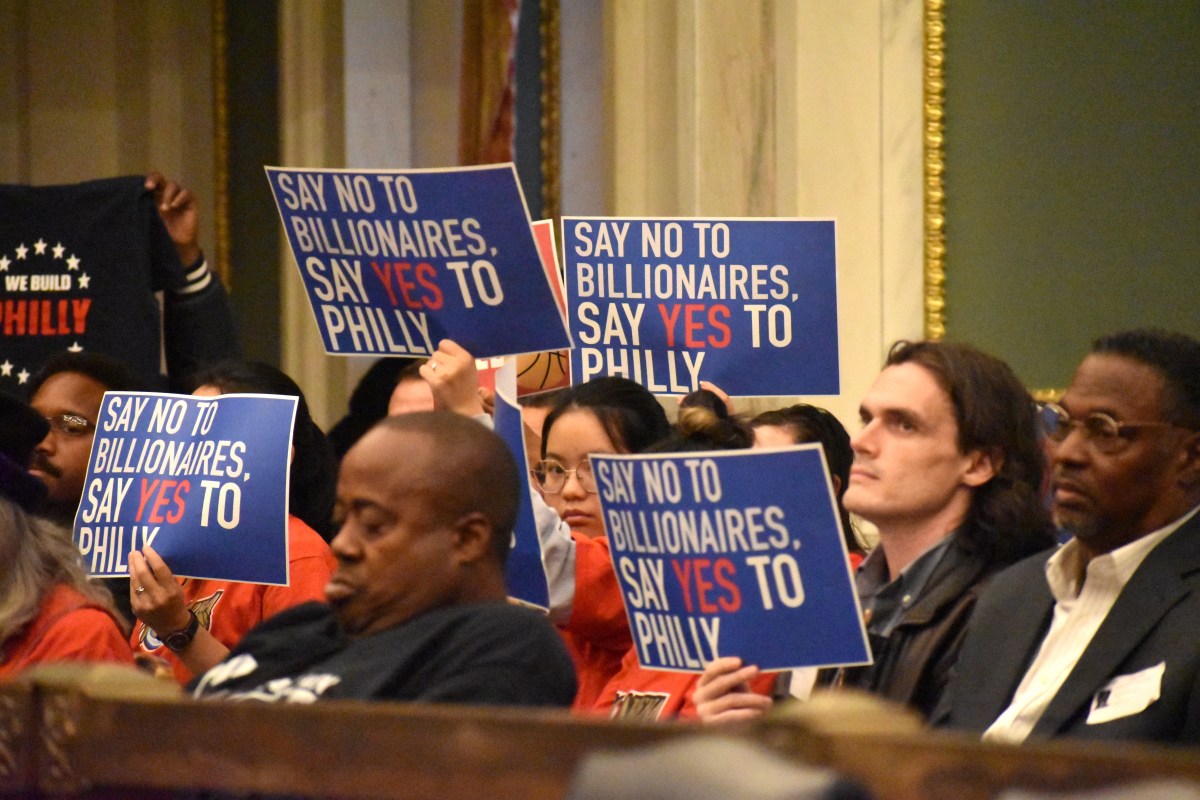

It paints a picture of a central bank, which once closely guarded its secrets, newly open to public feedback and willing to respond by reshaping its policies. Many groups pleaded with the Fed to allow nonprofits access to the program.

“I find the omission of nonprofits from the Main Street lending program not only unconscionable, but economically disastrous…the cost to society will be much greater in the long run than the cost to support these organizations with loans,” Lisa Gold of the New York-based Asian American Arts Alliance wrote in an email.

Others sought reduced minimum loans and a lower bar for borrowing.

“I would encourage you to lower the minimum loan amount from $1 million to $500,000,” Mitesh Ravel, a Subway franchise owner in Virginia, wrote in an email. “As a small business with 65 employees and about $5 million in revenue, $1 million is more than I need or can afford to finance.”

In tweaking the program, the Fed ultimately lowered the minimum loan threshold to $250,000. It also released a proposal to allow nonprofits to borrow alongside private companies.

So far 300 lenders have signed up to participate, Fed Chair Jerome Powell said this week. He also indicated the Fed was open to making further adjustments to the program.

(Reporting by Ann Saphir, Lindsay Dunsmuir, Jonnelle Marte and Dan Burns; Editing by Chizu Nomiyama, Richard Chang and David Gregorio)