(Reuters) – Dallas Federal Reserve President Robert Kaplan on Monday said his forecast for 5% U.S. GDP growth this year could be an underestimate, given the likelihood of further fiscal support and the rollout of vaccines.

Americans will “gradually” engage more fully in the economy between now and June as coronavirus vaccines are rolled out, Kaplan predicted in an International Energy Forum, and “we think we see substantial improvements in mobility and engagement in the third quarter and fourth quarter.”

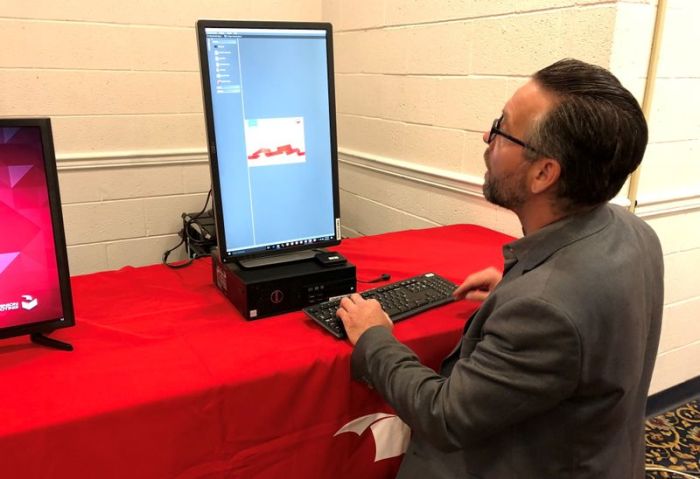

“If we are wrong, the risks are to the upside – we may grow faster,” Kaplan added. Unemployment, now at 6.3%, will decline to below 4% next year, he told the Garland Chamber of Commerce later on Monday.

And though he expects short-term inflation pressures due to shortages in commodities like chips and lumber to be transitory, the “jury is out” on whether longer-term downward price pressures from globalization or technology will offset the upward push on inflation from a tighter labor market.

With the Biden administration’s proposed $1.9 trillion pandemic relief package looking increasingly likely to win passage in Congress, economists have already begun to raise their 2021 GDP forecasts.

Bank of America economists on Monday said they now expect the U.S. economy to grow 6.5% this year, up from a previous call for 4.5% growth, based on the expected size of the stimulus package and better news on the economy and the virus.

Fed officials will deliver their next set of quarterly economic projections at a policy meeting in March.

Their median forecast from December of 4.2% growth this year is looking increasingly stale amid strong consumer spending.

Kaplan said a lot will depend on the handling of the pandemic, especially the pace of vaccine rollouts globally.

The United States has partially or fully vaccinated about 44 million people, or about 13% of the population, according to figures from the U.S. Centers for Disease Control and Prevention. Only Israel, the United Arab Emirates, and the United Kingdom have rolled out vaccines at a faster pace.

The Fed has kept interest rates at zero and has pledged to keep them there until the economy reaches full employment, and inflation reaches the Fed’s 2% goal and looks headed to exceed that. It is also buying $120 billion in bonds a month to push down on long-term borrowing costs.

Once the pandemic is weathered, Kaplan said, it would be “healthy” to wean financial markets from that super-easy Fed policy.

(Reporting by Ann Saphir; Editing by Paul Simao and Andrea Ricci)