By Jonnelle Marte

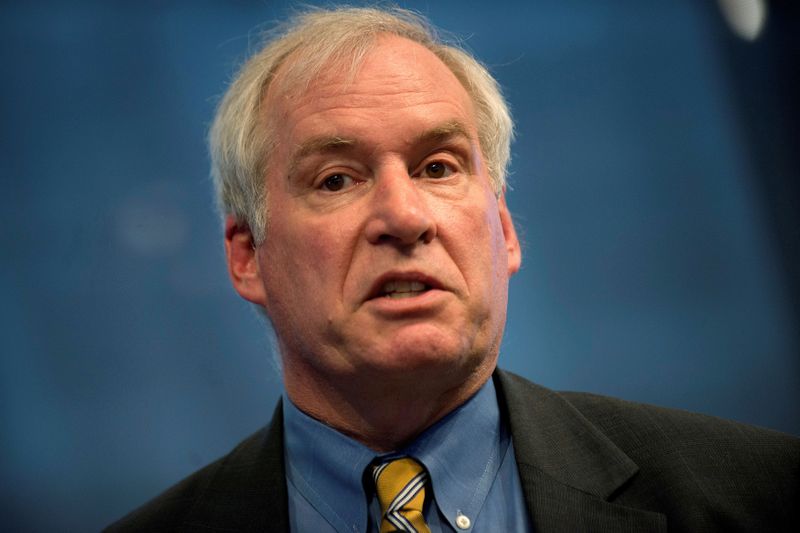

(Reuters) -Federal Reserve officials need to keep a close watch on financial stability risks, and rising home prices in particular should be monitored, Boston Fed President Eric Rosengren said on Wednesday.

“Long periods of very low interest rates do encourage people to take risk,” Rosengren said during a virtual conversation organized by the New England chapter of the National Association of Corporate Directors.

The surge in home prices seen in some markets is similar to the rise during the boom and bust of the last housing crisis, though that pattern may not necessarily be repeated this time around, Rosengren said.

The policymaker said that some of the markets that required support from the Fed at the height of the pandemic, including the Treasury market, mortgage-backed securities and money-market funds, need to be more resilient against shocks.

“The money-market fund reform that occurred after the last crisis actually made things worse and so far there has not been a solution,” Rosengren said, adding that prime money-market funds “need to be cleaned up.”

And the Fed official said regulators need to take a close look at stablecoins, a type of cryptocurrency that is pegged to a more traditional currency, such as the dollar, but can still experience volatility. “A ‘stablecoin’ is a misnomer,” Rosengren said.

His remarks come at a time when the Boston Fed is researching the technology that could be used to develop a central bank digital currency, an issue that is gaining more attention from Congress.

Rosengren said the research, which could be released in early July, may show there is promising technology that could handle a large volume of transactions in a short period of time.

But some major policy questions over what a digital currency should accomplish have yet to be answered, he said.

(Reporting by Jonnelle Marte in New YorkEditing by Rosalba O’Brien and Matthew Lewis)