LONDON (Reuters) – Shares in payments company Finablr

In response to the share price drop, Finablr in a statement said it had sought clarifications from BRS, an investment vehicle owned by Shetty, which had reassured it about the level of security represented by its holding in Finablr and the talks it has had with its banking group about repayment or refinancing of the debt.

Finablr declined to immediately give further details when contacted by Reuters.

Another of Shetty’s London-listed firms, United Arab Emirates’ largest private healthcare provider NMC Health

Shetty’s Finablr in 2015 bought British travel money firm Travelex, which this month suffered a cyber attack that forced its systems offline for weeks and caused chaos for holidaymakers.

In its statement, published after markets closed on Friday, Finablr said the cyber incident at Travelex was being resolved and would not impact 2019’s results, nor was it expected to have a material impact on the company’s performance in the current year.

More than 300 million pounds ($394.32 million) was wiped off Finablr’s market capitalization on Friday, reducing it to 665 million pounds.

“The outlook for Finablr is poor. The fact the founder used roughly half of the company’s shares as collateral for a loan suggests the situation is serious,” said CMC Markets analyst David Madden.

“The Travelex crisis has clearly hit the founder hard and it suggests that he is scrambling around to get financing. Even if the funding issue is sorted out, Finablr’s share price will probably struggle to recover – like NMC Health.”

Shetty did not immediately respond to requests for comment.

The Travelex hack left the majority of British high street banks, which use the company to provide travel money to customers, unable to take online orders.

Finablr floated on the London Stock Exchange in May last year and since then it has fallen nearly 44% in value.

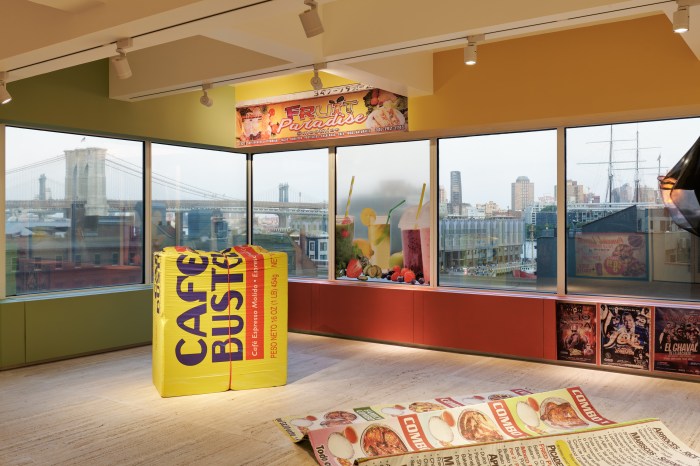

Graphic: Finablr https://fingfx.thomsonreuters.com/gfx/buzzifr/15/5434/5434/Pasted%20Imag…

($1 = 0.7608 pounds)

(Reporting by Lawrence White and Iain Withers in London and Muvija M in Bengaluru; editing by Rachel Armstrong, Elaine Hardcastle, Kirsten Donovan)