By Medha Singh

(Reuters) – U.S. stock index futures rose on Tuesday as a top Chinese health adviser said the coronavirus outbreak may plateau in the next few weeks, while Sprint shares surged on hopes of favorable ruling for its merger with T-Mobile.

China’s foremost medical adviser on the epidemic said infections may be over by April, with the number of new cases already declining in some places, even as the death toll crossed 1,000.

However, investors were on edge as it was still unclear how much of a hit the world’s second-largest economy would take as factories struggled to resume production after an extended Lunar New Year break.

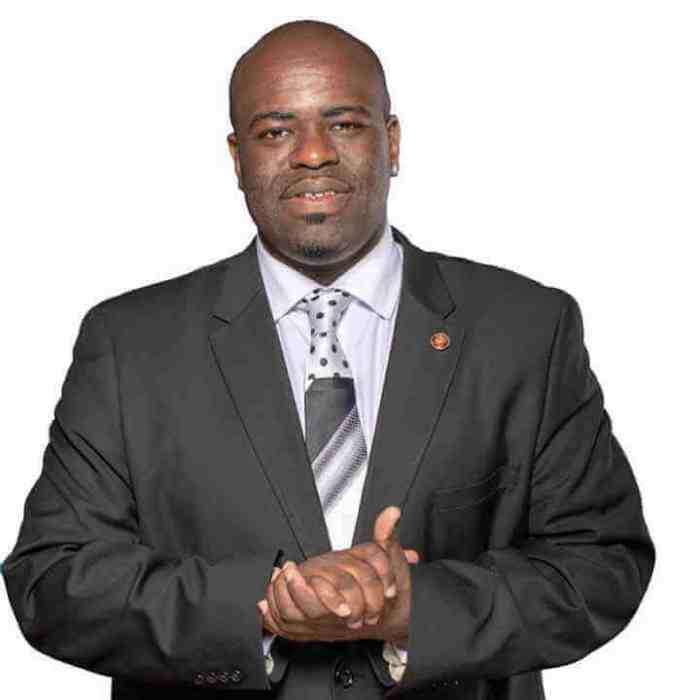

“Now it’s no longer a question of whether the coronavirus epidemic will lead to an economic slowdown, but how painful this slowdown will be,” said Lukman Otunuga, senior research analyst at FXTM.

“The scale of the impact can only be determined when the spread of the virus begins to slowdown and the outbreak gets under control.”

The S&P 500 <.SPX> and the Nasdaq closed at record highs on Monday as largely better-than-expected quarterly earnings, positive U.S. economic data and China’s recent stimulus measures helped investors look past fears about the coronavirus fallout.

At 7:04 a.m. ET, Dow e-minis <1YMcv1> were up 61 points, or 0.21%. S&P 500 e-minis Sprint T-Mobile shares jumped 8%, while larger rivals Verizon Communications Inc Fourth-quarter earnings have largely been upbeat, with about 71% of the 324 S&P 500 companies that have reported results so far beating profit estimates.

Hasbro Inc Markets will also look out for any mention of the potential threat from the coronavirus in Federal Reserve Chair Jerome Powell’s address to the Congress on Tuesday.

His testimony is expected to begin at 10 a.m. ET (1500 GMT).

(Reporting by Medha Singh in Bengaluru; Editing by Subhranshu Sahu)