(Reuters) – The U.S. Securities and Exchange Commission waded into the battle between small investors and Wall Street hedge funds on Friday, warning brokerages and social-media traders it was on alert for any wrongdoing in this week’s roller-coaster trade.

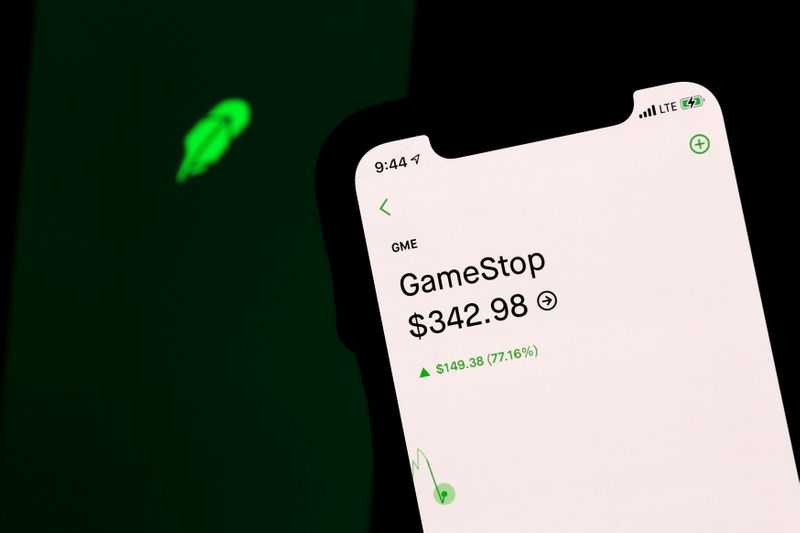

GameStop shares rallied again, awarding retail investors the advantage in the latest round of their week-long slugfest against major financial institutions that had shorted the video game retailer.

The so-called “Reddit rally” has inflated stock prices for GameStop and other previously downtrodden companies that individual investors championed on social media forums such as Reddit’s Wallstreetbets, which has almost 6 million members.

GameStop surged 68% on Friday after brokerage apps including Robinhood eased some restrictions on trading. GameStop shares fell on Thursday following the curbs, which drew calls for scrutiny from regulators and outrage from celebrities and politicians on both sides of the political aisle.

Robinhood said late on Friday opening new positions in 50 securities including GameStop is currently allowed, but limited.

Koss Corp was up 53%, but both the headphone maker and GameStop remained below peaks reached earlier this week.

Hedge funds and other short sellers had a bruising week. GameStop short sellers have endured mark-to-market losses of $19.75 billion so far this year, according to S3 Partners. Even so, the stock remained highly shorted, with $11.2 billion short interest.

The SEC issued a rare joint statement from its acting chair and commissioners that said it was working closely with other regulators and stock exchanges “to protect investors and to identify and pursue potential wrongdoing” and would “closely review actions … that may disadvantage investors” or hinder their ability to trade stocks.

The showdown between small traders and professional short-sellers also drew scrutiny from lawmakers, the White House and the attorneys general of New York and Texas.

Texas Attorney General Ken Paxton issued 13 civil investigative demands, the civil equivalent of a subpoena, on Friday to Robinhood and others that put curbs on stock trading, calling it “shockingly unprecedented and wrong.”

The battle added to uncertainty in equity markets that had looked ripe for a pullback. Some funds were forced to sell some of their best-performing stocks, including Apple Inc, to cover billions of dollars in losses on short positions.

All three main indexes suffered their biggest weekly fall since the end of October on Friday, closing down around 2%.[.N]

SURGE IN VOLUME

The surge in volatility has led to a huge increase in volume, totaling over 20 billion shares in each of the past two sessions across U.S. exchanges for the most active trading days on record going back to 2014, according to Refinitiv data.

The “Reddit stocks” have accounted for as much as 7.6% of that volume, according to Piper Sandler analyst Rich Repetto.

“The markets were vulnerable to a decline … and this Reddit activity was the catalyst that sort of triggered the sell-off,” said Sam Stovall, chief investment strategist at CFRA Research.

GameStop marked a near 400% weekly gain, eclipsed by Koss’s 1,800% week. AMC Entertainment rose 54% on Friday, and was up 278% for the week, while Express added almost 28%.

Virgin Galactic closed up 2.7%, Bed Bath & Beyond was up 5%, and American Airlines fell 5% after a rally the prior session. Since the start of the week, BlackBerry Ltd more than doubled to touch $36 on Wednesday before easing back to $19.96 on Friday. [.TO] Silver continued a blistering rally.

While some companies swept up in the so-called “Reddit rebellion” have used the opportunity to raise capital, most have said little about the volatility in their shares. GameStop did not reply to multiple requests for comment. AMC, BlackBerry and Koss did not immediately respond to requests for comment.

For a full list of Reuters stories about the GameStop phenomenon, please see:

RESTRICTIONS

Restrictions imposed on Thursday were driven by the high concentration of risk in hot stocks and by increased clearinghouse capital and deposit requirements, Piper Jaffrey said.

While Robinhood eased the curbs on Friday, it was still not allowing purchases of fractional shares in GameStop and some other companies, meaning smaller investors must bet more to buy-in. The brokerage was also limiting the number of shares any one account could hold.

London-based trading platform Freetrade disabled buy orders for U.S. stocks but will allow users to exit positions.

While the battle could limit short-sellers’ influence on the market, analysts said, the fact remained that the prices of stocks will eventually fall if they are overvalued.

“These moves … can go a lot further than people can expect, but they end with a quick move back down,” said David Starr, vice president of quantitative analysis at Simpler Trading. “People race for the exits very, very quickly.”

Citron Research’s Andrew Left, who sparked the conflict with a call against GameStop, said Citron would no longer publish short-selling research and would shift to writing on companies that he thinks hold value.

“When we started Citron, it was to be against the establishment, but now we’ve actually become the establishment,” Left said in a video on Friday. “The Citron narrative is going to change and have a pivot.”

(Reporting by Sagarika Jaisinghani, Medha Singh, Sruthi Shankar, Munsif Vengatill, Devik Jain and Anirban Sen in Bengaluru; Fergal Smith in Toronto; Anna Irrera, Saqib Iqbal Ahmed, Lewis Krauskopf, John McCrank, Chris Prentice and April Joyner in New York; Susan Heavey in Washington; Sujata Rao-Coverley, Tom Wilson and Thyagaraju Adinarayan in London; Writing by Patrick Graham, Nick Zieminski and Sonya Hepinstall; Editing by Saumyadeb Chakrabarty, David Gregorio and Daniel Wallis)