It’s no secret that living in New York City is expensive, but a new tool from NYC Comptroller Scott M. Stringer gives more details on how the affordability crisis here has grown.

Stringer’s office released an interactive tool called the Affordability Index to break down a middle-income New Yorker’s budget, see where costs are going up and analyze challenges that residents here face.

Costs for basic necessities like housing, transportation, health- and child-care and food have risen at nearly twice the rate of incomes, according to the index. Living in New York City is getting more expensive in multiple ways, meaning New Yorkers are unable to save for the future.

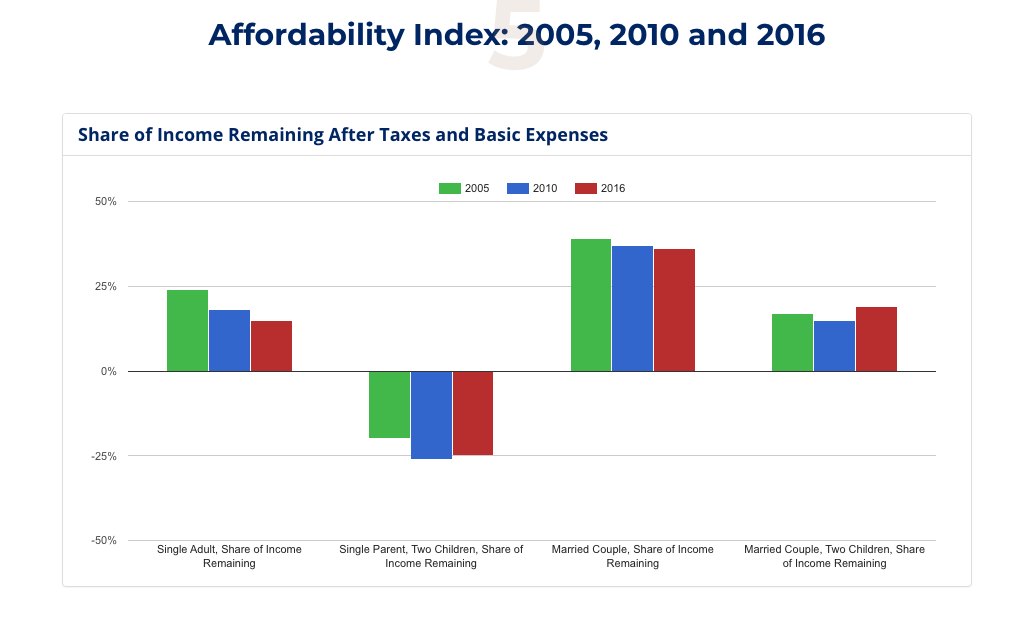

Stringer’s office looked at four types of households living in New York City: single adult ($50,000 income); single parent with two children ($41,000 income); married couple ($106,000 income); and married couple with two children ($97,000 income).

The index looked at the growth in the cost of basic expenses, including rent and utilities, food, transportation, healthcare and so, on between 2005 and 2016. It calculated the share of these household incomes remaining after those expenses and taxes.

“We all feel the squeeze from incomes that lag behind rising costs – but now, we’re showing exactly what that means for New Yorkers across our city,” Stringer said in a statement. “Over the last decade, the money that New Yorkers could be putting away — for retirement, for college, or even for a simple family night out — has been shrinking.”

One glaring, growing burden is the cost of housing. While typical household incomes increased by 2.7 percent per year for a single parent or 1.8 percent for a single adult household, median rents in New York City increased on average by 4 percent a year.

“Talk to a New Yorker for more than five minutes and you’ll find yourself talking about housing costs,” said Kristin Morse, executive director of The New School Center for New York City Affairs, which focuses on how public policy impacts low-income New Yorkers.

Though the tool may be limiting since it focuses on median incomes, Morse said it still helps shed light on the struggles New Yorkers are facing.

What I find useful about the Affordability Index is that it shows — in a really clear way — the “upward trend of most major expenses,” she said. “Of course, housing leads the way — but the Comptroller’s tool also shows rising child care, health care, and transportation costs. Policies like the half price metro cards currently being negotiated by the Mayor and Council could make a real dent in the monthly expenses of low-income families. Each of these different expense categories represents potential policy levers for struggling New Yorkers.”

The index will be updated annually to monitor New Yorkers’ economic struggles. See more at comptroller.nyc.gov/reports/affordability-index.