(Reuters) – Markets for stocks and other risky assets could suffer a second swoon if the coronavirus spreads more widely, lockdowns are reimposed or trade tensions surge again, the International Monetary Fund warned on Thursday.

Equity markets tailspinned into bear market territory in record time earlier this year as the virus and related lockdowns pounded sentiment, but they have broadly rallied from their March 23 low. The S&P, which fell 34% in just 23 trading days, has been boosted by central bank support, and is now roughly 10% off its record high.

A “disconnect” between financial markets and economic prospects has emerged, said the report, by Tobias Adrian, Director of the IMF’s Monetary and Capital Markets Department and Fabio Natalucci, a deputy director in the department. That “raises the specter of another correction in risk asset prices,” with valuations across many equity and corporate bond markets “stretched.”

The warning came just a day after the IMF slashed its 2020 global economic forecasts further.

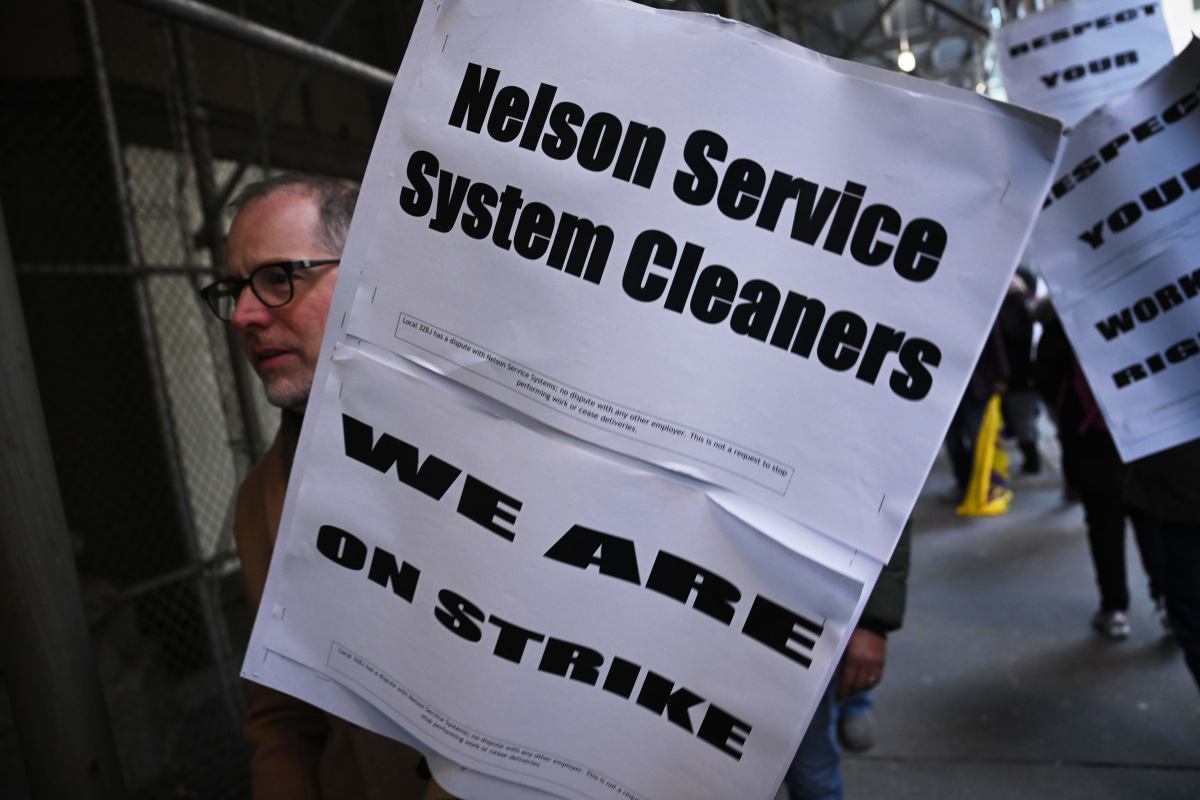

A correction could be prompted by a deeper and longer recession than currently anticipated, a second wave of the virus or reinstated containment methods. A broadening of global social unrest in response to rising economic inequality could also damage investor sentiment, the IMF said.

“We worry about scarring in the economy, meaning the crisis might be longer than expected and deeper than expected,” said Adrian. “Scarring is due to the high level of unemployment and the potential for insolvency. These are difficult to reverse.”

A sharp correction in asset prices could lead to large outflows in investment funds, as seen early in the year, possibly triggering fire sales of assets, Adrian wrote.

The IMF said while banks entered the crisis with higher liquidity and capital buffers, insolvencies will test the resilience of the sector.

(Reporting by Megan Davies; Editing by Dan Burns, Tom Brown and Andrea Ricci)