(Reuters) -Intel Corp will greatly expand its advanced chip manufacturing capacity as the new chief executive announced plans to spend as much as $20 billion to build two factories in Arizona and open its factories to outside customers.

The move by CEO Pat Gelsinger on Tuesday aims to restore Intel’s reputation after manufacturing stumbles sent shares plunging last year. The strategy will directly challenge the two other companies in the world that can make the most advanced chips, Taiwan’s Semiconductor Manufacturing Co Ltd (TSMC) and Korea’s Samsung Electronics Co Ltd.

And it will aim to tilt a technological balance of power back to the United States and Europe as government leaders on both continents have become concerned about the risks of a concentration of chipmaking in Taiwan given tensions with China.

Intel shares rose 7.5% after the company disclosed its new strategy and full-year financial guidance for 2021. Some investors such as Third Point LLC had previously urged Intel to consider spinning off its costly chip manufacturing operations.

Intel said it expects $72 billion in revenue and adjusted earnings per share of $4.55, compared with analyst estimates of $72.9 billion and $4.77 per share, according to Refinitiv data. The company said it expects to spend $19 billion to $20 billion on capital expenditures.

Gelsinger said that 2021 forecast “reflects the industry-wide shortage” of some components such as substrates.

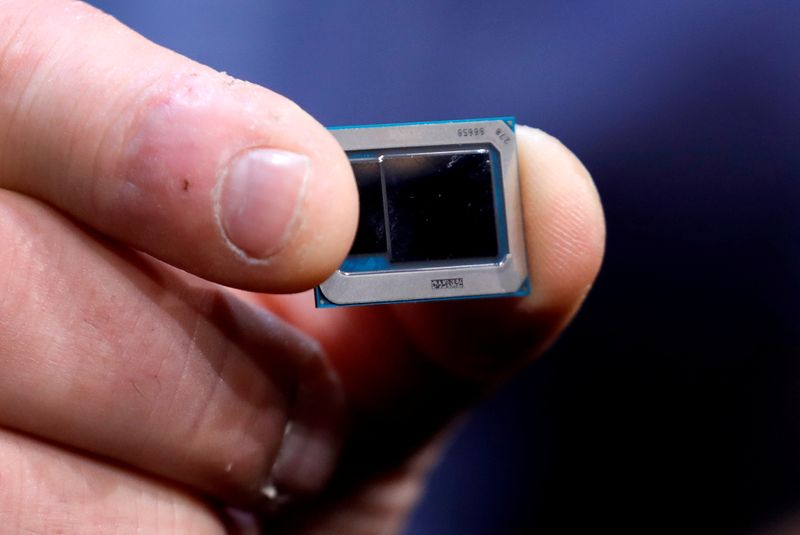

Intel is one of the few remaining semiconductor companies that both designs and manufactures its own chips. Rival chip designers such as Qualcomm Inc and Apple Inc rely on contract manufacturers.

In an interview with Reuters, Gelsinger said Intel has “fully resolved” its problems with its most recent manufacturing technology and is “all systems go” on chips for 2023. It now plans a massive manufacturing expansion.

That will include spending $20 billion on two new factories at an existing campus in Chandler, Arizona, that will create 3,000 permanent jobs. Intel will then work on future sites in the United States and in Europe, Gelsinger said.

Intel will use those factories to make its own chips but also open them to outside customers in what is called a “foundry” business model in the chip industry. Gelsinger said the new factories will focus on cutting-edge computing chip manufacturing, rather than the older or specialty technologies that some manufacturers such as GlobalFoundries specialize in.

“We are absolutely committed to leading process technology capabilities at scale for the industry, and for our customers,” Gelsinger said, adding that Intel has lined up customers for the new factories but could not disclose their names.

He did say on a webcast Tuesday that Amazon.com Inc, Cisco Systems Inc, Qualcomm Inc and Microsoft Corp support its efforts to offer chip manufacturing services. On a conference call, Gelsinger said that Intel “will pursue customers like Apple.”

The move is a direct challenge to TSMC and Samsung. The two have come to dominate semiconductor manufacturing business, moving its center of gravity from the United States, where much of the technology was once invented, to Asia, where more than two-thirds of advanced chips are now manufactured.

“Intel’s investment will help to preserve U.S. technology innovation and leadership, strengthen U.S. economic and national security, and protect and grow thousands of high-tech, high-wage American jobs,” U.S. Secretary of Commerce Gina Raimondo said in a statement.

Gelsinger said Intel will aim to change the global chip manufacturing balance by embracing the foundry business where it historically has been a minor player. Intel will offer chip customers the ability to license out its own technological crown jewels – known as x86 computing cores – as well as offer to build chips based on technology from Arm Ltd and RISC-V technology from startup SiFive.

“We will be picking our next sites within the next year for U.S. and Europe,” he said.

The American sites could benefit from a $30 billion subsidy package that lawmakers hope to bring to the floor of the U.S. Senate next month. The bill remains largely unwritten, and Gelsinger said on a conference call that Intel’s plan “does not depend on a penny of government support. It is the right strategy for us going forward.”

Intel also announced plans for new research collaboration with IBM focused on computing chip and packaging technology.

But even as Intel jumps into competition with TSMC and Samsung, it also plans to become a larger customer of theirs by turning to them to make subcomponents of its chips called “tiles” to make some chips more cost-effectively.

“I’ll pick the best process technologies wherever they exist,” Gelsinger said. “I leverage internal and external supply chains. I’ll have the best cost structure. That combination of supply, products and costs, we think is a killer combination.”

Intel has given few details of exactly how it will use outside factories, but analyst Patrick Moorhead of Moor Insights and Strategy said he expects Intel to use them as “gap fillers for some of the highest performance” chip parts until Intel can regain a manufacturing lead over its rivals.

(Reporting by Stephen Nellis in San Francisco; Editing by Lisa Shumaker)