By Svea Herbst-Bayliss

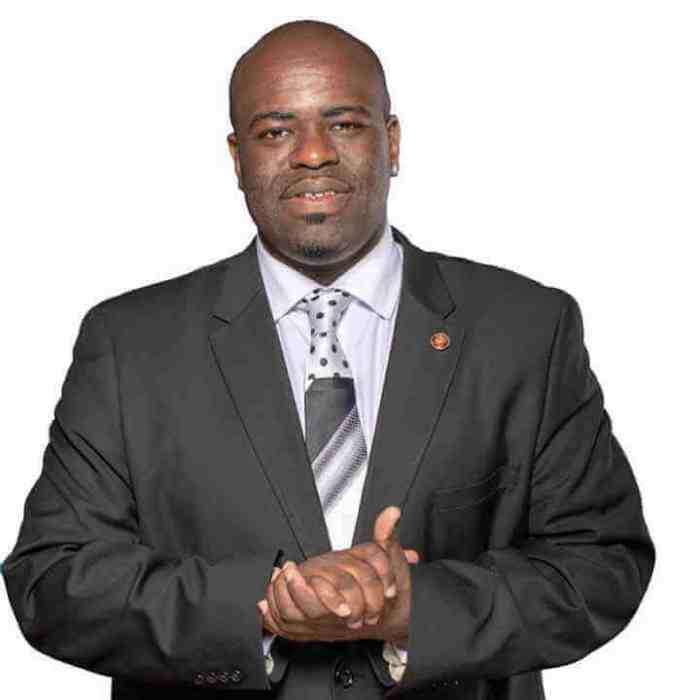

BOSTON (Reuters) – Investment manager Donald Netter, who has battled First Trust High Income Long/Short Fund (FSD) for years, is urging shareholders to fire the investment adviser at this year’s annual meeting, saying its returns are too low and fees too high.

Netter, whose Dolphin Limited Partnership I LP owns shares of FSD, filed a shareholder proposal with regulators on Thursday and is now soliciting votes before the March 9 annual meeting.

Five months ago Netter stepped up his battle with FSD by asking the closed-end fund to restructure or give investors their money back after it had traded at a discount for years.

Now he is taking the next step.

Netter’s filing says FSD’s historical actions have failed to close the market discount, that advisory fees are above median selected peer funds and that FSD’s returns have lagged the fund’s performance universe median and benchmark for one, three, and five years.

“All shareholders can do better than 5.4% of distributable earnings (0.93) on NAV (net asset value),” the filing states.

While closed-end funds sometimes trade at a discount, the range is traditionally much smaller, analysts said. Netter, who first began complaining to FSD in 2018, said the fund’s managers had failed to appropriately swap out certain fixed rate securities.

Mackay Shields LLC subadvises the fund. A representative for First Trust Advisors could not immediately be reached for comment.

(Reporting by Svea Herbst-Bayliss; Editing by Tom Brown)