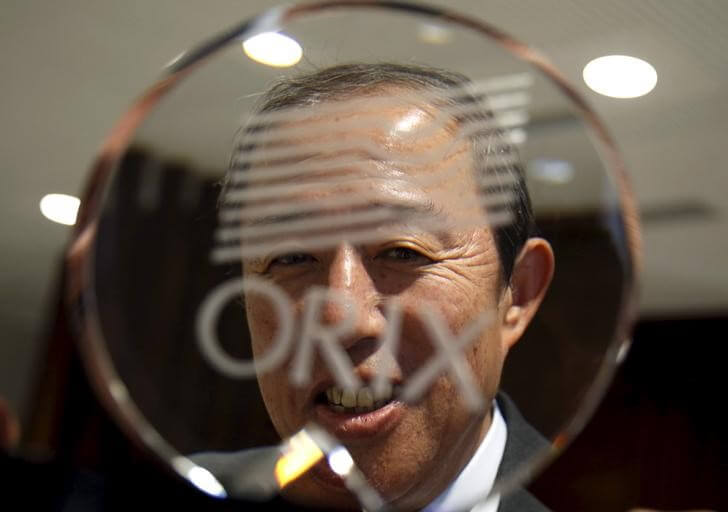

TOKYO (Reuters) – Japanese financial services company Orix Corp <8591.T> has bought Boston Financial Investment Management, a U.S. money manager specialized in tax credit investments for low-income housing suppliers, two sources said on Saturday. Orix paid several hundred million dollars to buy Boston Financial Investment Management, said the sources, who had direct knowledge of the deal but were not authorized to discuss the matter publicly. The U.S. Low Income Housing Tax Credit (LIHTC) program gives tax credits for new construction and rehabilitation of rental housing for low-income households.

Housing developers can sell the granted tax credits to fund projects and buyers of the credits can enjoy tax benefits.

Boston Financial is one of the largest LIHTC syndicators, which raise money from investors and buy tax credits. It has raised over $10 billion from institutional investors for LIHTC investments in more than 2,200 properties, the sources said. Orix, which bought investment manager Robeco from Dutch cooperative lender Rabobank in 2013, has been building up money management business overseas.

Orix and Boston Financial officials were not immediately available for comment.

(Reporting by Taiga Uranaka; Editing by Ed Davies)

Japan’s Orix buys U.S. housing tax credit syndicator: sources

Reuters