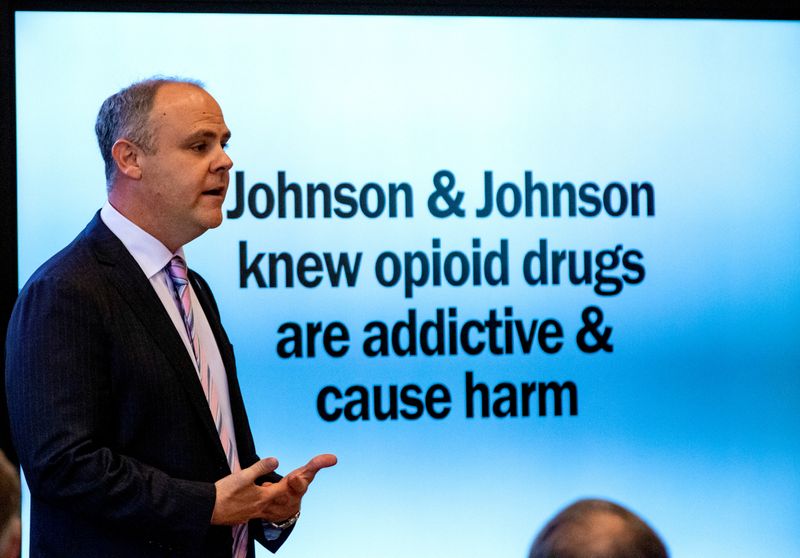

NEW YORK (Reuters) – New York state filed civil charges on Thursday accusing Johnson & Johnson of insurance fraud for downplaying the risks of opioid painkillers, including to doctors and elderly patients.

J&J and its Janssen Pharmaceuticals affiliate were accused of targeting elderly patients for opioid treatment despite the risks of side effects such as falls, fractures and neuropsychiatric symptoms.

The company was also accused of employing marketing materials, “seemingly independent” advocacy groups and “key opinion leaders” to dismiss opioid addiction as a myth.

“Misrepresentation of opioids to consumers for profit is inexcusable,” Governor Andrew Cuomo said in a statement.

In a statement, J&J called its marketing and promotion of opioids “appropriate and responsible. Janssen provided these medicines for doctors treating patients suffering from pain and worked with regulators to provide appropriate information about their risks and benefits.”

The charges by New York’s Department of Financial Services are the fourth in its opioid industry probe, following charges against Teva Pharmaceutical Industries Ltd and Allergan Plc, Endo International Plc and Mallinckrodt Plc.

J&J, based in New Brunswick, New Jersey, has proposed paying $4 billion to settle opioid claims by U.S. states, cities and counties.

It is separately appealing a $465 million judgment in Oklahoma from last November over its opioid marketing there.

New York said J&J manufactured opioid products in the state including Nucynta and the fentanyl patch Duragesic, and received multiple U.S. Food and Drug Administration letters challenging its Duragesic marketing claims.

The state also said J&J’s “Norman Poppy,” developed in 1994, once accounted for as much as 80% of the global supply for oxycodone raw materials.

Oxycodone is the main ingredient in OxyContin, made by the now-bankrupt Purdue Pharma LP.

The U.S. Centers for Disease Control and Prevention has said opioids have contributed to more than 400,000 deaths since 1997.

J&J was charged with violating two New York insurance laws, with civil penalties of up to $5,000 per violation.