(Reuters) – Kroger Co on Thursday forecast strong annual earnings as it reins in costs after record sales for 2020 on a boom in demand for groceries during the pandemic.

Kroger consistently topped sales estimates last year as consumers, looking to stock up on food and household essentials, rushed in droves to the websites and apps of big national retail chains to shop from the relative safety of their homes.

Shares in the supermarket chain that said online sales more than doubled in the fourth quarter rose about 2% in morning trade.

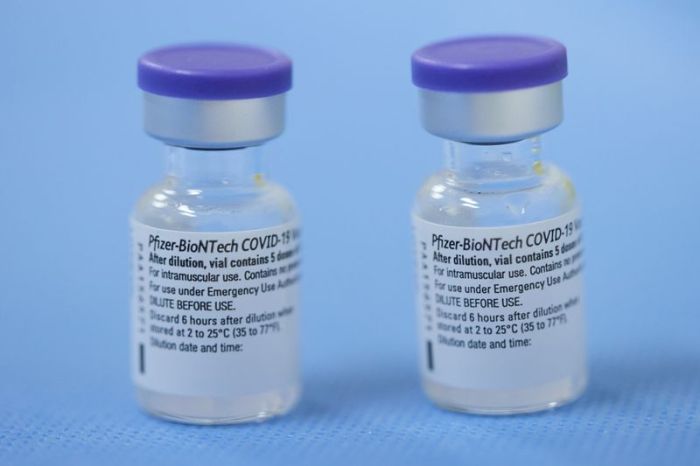

Analysts expect a similar sales growth would be difficult to replicate this year as the rollout of COVID-19 vaccines promises a return to relative normalcy, removing the need to hoard supplies.

The company forecast a 3% to 5% drop in adjusted full-year same-store sales, bigger than the 2.5% fall analysts were expecting.

“Due to the uncertainty surrounding trends in the food-at-home market as COVID vaccines roll out, we are sharing a wider range than we typically would,” Kroger Chief Financial officer Gary Millerchip said.

He added that much of the change in consumer shopping patterns including demand for more expensive cooking ingredients from new amateur chefs would continue to benefit the company in the long run.

The retailer forecast full-year profit per share between $2.75 and $2.95, above analysts’ estimates of $2.69, as it undertakes cost-saving initiatives in its sourcing, equipment purchases and supply chain.

The company though expects to spend $350 million more this year on employee wage increases.

Same-store sales, excluding fuel, rose 10.6% in the fourth quarter, beating the Refinitiv IBES estimate of a 9.4% rise. Full year sales rose 8.4% to a record $132.5 billion.

Excluding one-time items, Kroger earned 81 cents per share, beating estimates of 69 cents per share.

(Reporting by Uday Sampath in Bengaluru; Editing by Vinay Dwivedi)