By Tetsushi Kajimoto

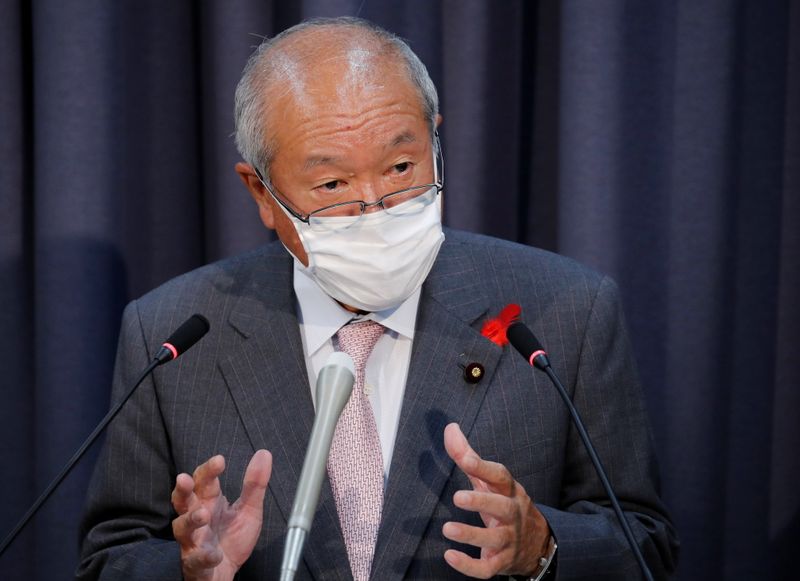

TOKYO (Reuters) -Japanese Finance Minister Shunichi Suzuki warned on Thursday against any sharp currency moves, saying he was closely watching the foreign exchange market as the yen hovered near 18-month lows against the dollar.

The new finance minister made the comment when asked about the yen’s recent weakening during an interview with a small number of news outlets. The yen has fallen about 8% against the dollar since the start of this year.

Japanese policymakers tend to warn against sharp yen rises, which could hurt the export-reliant economy. But Suzuki’s comments suggest authorities are also concerned about a rapid yen weakening, which could drive up import costs for the resource-poor country.

“Stability in currencies is important for the Japanese economy. We will closely watch currency market moves,” said Suzuki.

“I’ll refrain from commenting on currency levels as we shouldn’t affect the market,” he added.

Suzuki assumed his post on Monday, taking over from his predecessor and brother-in-law Taro Aso, under the newly formed cabinet of Prime Minister Fumio Kishida.

The dollar has been firming amid jitters that surging energy prices could spur inflation and interest rate hikes. A wide interest rate differential between Japan and the United States has also helped support the dollar against the yen.

The yen stood at 111.30 versus the dollar, remaining within sight of the 18-month trough of 112.08 seen last Thursday.

When asked about a planned stimulus package, Suzuki declined to comment on its size and content, saying that he will need to discuss the matter with the ruling coalition.

The minister reiterated a government goal of achieving a primary budget surplus by the fiscal year ending in March 2026, even though its heavy stimulus spending appeared to make it an even more elusive target.

Suzuki vowed to compile a “high quality budget” for the next fiscal year, underscoring the need for “wise spending and expenditure reform.”

(Reporting by Tetsushi Kajimoto, Editing by Chang-Ran Kim, Ana Nicolaci da Costa and Kim Coghill)