By Laura Sanicola

NEW YORK (Reuters) -Oil settled lower on Thursday, snapping a three-day rally on renewed concerns over demand due to rising COVID-19 infections and as Mexico restored some output after a fire disrupted supplies.

Losses were limited by the potential for other supply interruptions. Energy companies prepared for the possibility of

a severe storm hitting the U.S. Gulf Coast this weekend.

Brent crude settled down $1.18, or 1.6%, at $71.07 a barrel. U.S. West Texas Intermediate oil settled down 94 cents, or 1.4% at 67.42 a barrel.

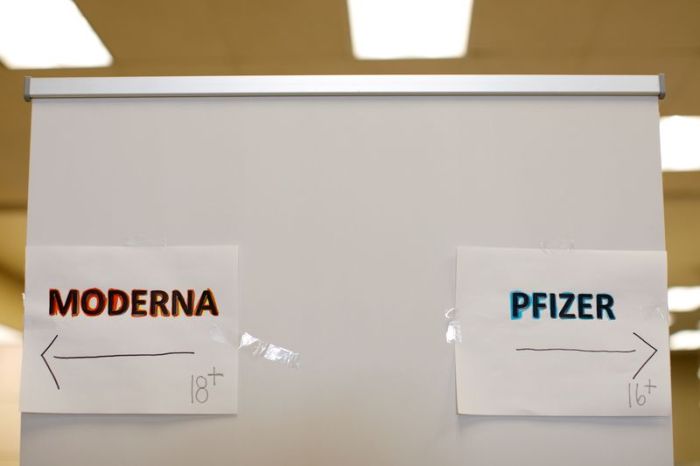

Fresh COVID-19 outbreaks fueled by the Delta variant raised concerns about the strength of the economic recovery globally.

Oil was also weighed down by broader weakness in equity markets later in the day, analysts said. [.N]

Mexico has begun restoring output after a fire on an offshore platform on Sunday knocked out more than 400,000 barrels per day (bpd) of production. By Tuesday, state oil firm Petroleos Mexicanos (Pemex) had recovered 71,000 bpd of production and expected to add an additional 110,000 bpd this week.

However, Pemex’s efforts to restore oil production could lag official projections, people close to the matter told Reuters, as re-connecting wells is proving more difficult than planned.

Mexican President Andres Manuel Lopez Obrador on Thursday said Pemex will produce an average of 1.8 million bpd by year end, despite the fire.

Royal Dutch Shell, Chevron Corp and others on Thursday began evacuating nonessential personnel from offshore U.S. Gulf of Mexico platforms ahead of a storm expected to enter the Gulf this weekend.

The storm brewing in the Caribbean Sea could become a major hurricane and strike the U.S. Gulf Coast by Sunday, the National Hurricane Center said. Hurricanes with winds of up to 111 miles per hour (178 km) are classified as major and can bring devastating damage onshore.

“The oil companies are getting way ahead of this storm, which is lending the market some support and offsetting some of the concern about more supply entering the market,” said John Kilduff, partner at Again Capital LLC in New York.

On Wednesday, Brent rose 1.2% and U.S. crude jumped 1.7%, as the U.S. Energy Information Administration reported that American crude inventories fell last week for a third straight week and overall fuel demand increased to the most since March 2020.

On Friday, investors will watch Federal Reserve Chair Jerome Powell speak to the annual Jackson Hole economic conference, but few expect hints about when the U.S. central bank may start reducing asset purchases.

The Organization of the Petroleum Exporting Countries meets on Sept. 1 to decide its policy amid calls from the United States to add more barrels to the market to help the global economic recovery.

(Reporting by Laura Sanicola in New YorkAdditional reporting by Dmitri Zhdannikov in London, Aaron Sheldrick in Tokyo and Dmitry Zhdannikov in LondonEditing by Mike Harrison and Matthew Lewis)