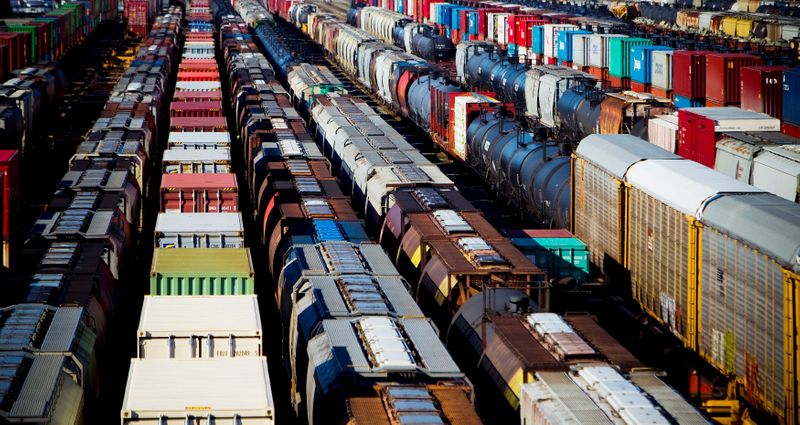

WINNIPEG, Manitoba, (Reuters) -North America’s freight rail customers, from grain shippers to logistics companies, are choosing sides as Canadian Pacific Railway Ltd and Canadian National Railway fight to buy Kansas City Southern.

A takeout of KCS, would be the first major North American railroad combination in more than 20 years and create the first network to include the United States, Canada and Mexico.

CN , Canada’s biggest railroad, made an unsolicited $30 billion bid for KCS on Tuesday, topping CP’s agreed $25 billion bid, but CP said last week it was not considering raising its offer.

CN said on Monday that it was filing 409 letters of support from shippers and suppliers with the regulator, U.S. Surface Transportation Board (STB), pulling roughly even with CP’s stated level of support.

CP, which announced its combination with KCS on March 21, has said that 416 shippers and other stakeholders have written to STB in support.

CP supporters include shipping, container company Hapag-Lloyd, agriculture company Viterra Inc, an association representing Mexican auto makers, and oil refiner Valero Energy Corp.

If CP buys KCS, the bulked-up company will be able to better compete in North Dakota with dominant railway BNSF Railway Co, said Kevin Karel, general manager at The Arthur Companies, which ships corn and other crops by rail.

CP’s line crosses the agricultural state of North Dakota while CN’s does not.

“We’re really remote here, and so we need access to far more destinations, and that’s where this KCS merger really helps North Dakota farmers,” Karel said in an interview.

CN maintains that its combination with KCS would create a network that is shorter and faster than rail or truck competitors.

Its supporters include pork producer Maple Leaf Foods and steel manufacturer ArcelorMittal.

Some, like Coca-Cola Co, marine terminal operator DP World, Canadian grain handler Richardson International and U.S. food company Conagra are publicly supporting both rail bids.

Shippers’ views on the competing bids to the board may determine how KCS assesses the relative regulatory risks, investment bank Credit Suisse said in a note. CP has no overlapping rail networks with KCS, unlike CN which runs parallel for about 100 kilometres (62 miles) in Louisiana, making it easier for CP’s deal to clear regulatory hurdles.

CP on Saturday welcomed the U.S. regulator upholding a waiver that exempts KCS from the same scrutiny larger railroads face during proposed mergers. The STB had granted KCS, the smallest of the Class 1 railways, an exemption from new merger rules in 2001 because a combination involving KCS did not raise the same concerns that any transaction among bigger railways might create.

U.S. agribusiness Cargill Inc, and industry groups for chemical producers, corn refiners, and a trade group that promotes U.S. wheat exports had opposed use of the waiver, saying that a takeover of KCS is big enough to warrant full scrutiny.

(Reporting by Rod Nickel in WinnipegEditing by Marguerita Choy)