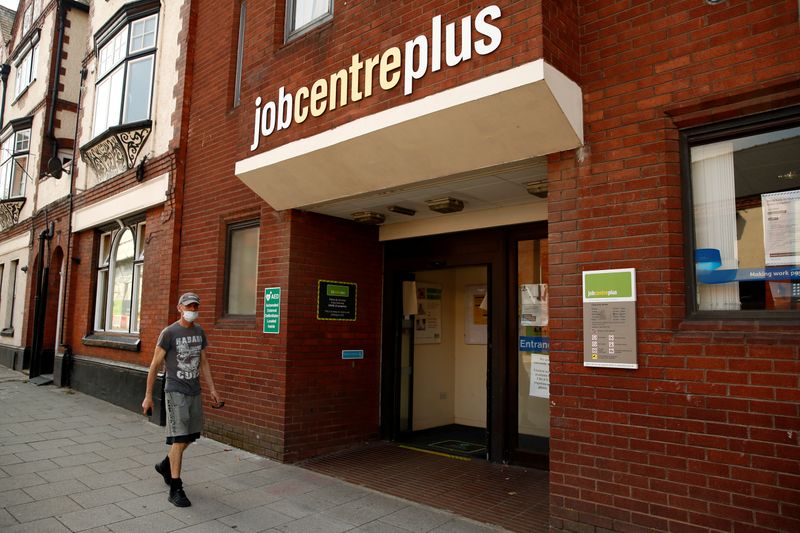

LONDON (Reuters) – Britain’s unemployment rate rose for the first time since the coronavirus lockdown began in March, prompting fresh calls for finance minister Rishi Sunak to extend a job subsidy programme which is due to expire next month.

The unemployment rate increased to 4.1% in the three months to July from the 3.9% level it had clung to since early 2020, in line with the average forecast in a Reuters poll of economists.

Sunak’s coronavirus job subsidy scheme has shielded millions of workers, and the number of people in employment fell less than feared in the figures published on Tuesday.

Although redundancies rose by 48,000 to 156,000, the biggest increase in over 10 years, so far they are well below their peak during the 2008 financial crisis.

Job losses are likely to accelerate in September and October when employers, many of whom are already worried about the prospect of a Brexit trade shock in the coming months, will have to pay more towards the cost of the furlough scheme.

Sunak – who has said he cannot keep extending the job protection scheme, which is estimated to cost 54 billion pounds ($70 billion) over its March-October duration – faced calls from lawmakers in his own Conservative Party to give targeted help to workers in sectors hardest hit by the pandemic.

“I have not hesitated to act in creative and effective ways to support jobs and employment, and will continue to do so,” he told parliament.

A single-month estimate for the unemployment rate, which is more timely but less representative than the three-month data, jumped to 4.4% in July. An experimental weekly estimate hit 4.8% in the last week of the month.

Separate tax office data showed the number of staff on company payrolls fell by a monthly 36,000 in August, more than in July but still only a fraction of mass layoffs in April and May. The ONS had previously reported 114,000 job losses for July, but revised this down sharply after receiving more data.

Overall, the payroll numbers fell by 695,000 between March and August – less than the previous estimate for job losses between March and July.

Similarly, official data showed a much smaller-than-expected fall of 12,000 in the number of people in employment in the three months to July, a tenth of the Reuters poll forecast.

However, the Office for National Statistics said its figures might be “slightly impacted” by its switch to interviewing people by telephone since the COVID-19 pandemic, which over-represents homeowners who are at less risk of unemployment.

CALL FOR TALKS

The Bank of England has forecast that unemployment will hit 7.5% at the end of this year, when it is expected to expand its bond-buying stimulus programme again.

The leader of the opposition Labour Party urged the government to hold urgent talks with the trade unions, businesses and Labour to come up with support and training programmes.

All options – including the Trades Union Congress’ job protection and skills upgrade plan and schemes similar to Germany’s short-time work programme – should be looked at, Keir Starmer told the annual conference of the TUC.

“But the principles are clear. Expand part-time working and reward employers who keep people on rather than cutting jobs… Target those sectors most in need – for example retail, hospitality…Provide certainty for workers and businesses,” he said.

The number of job vacancies rose to 434,000 in the three months to August, about 30% higher than in the April-to-June period but almost half their level before the pandemic.

Companies in sectors such as tourism and high-street retail have announced major job losses. London’s City Airport said on Monday it needed to cut up to 239 jobs or 35% of its staff, and similar reductions are expected at the much larger Heathrow.

($1 = 0.7758 pounds)

(Reporting by William Schomberg and David Milliken, editing by Ed Osmond and Emelia Sithole-Matarise)