NEW YORK (Reuters) – U.S. stocks ended lower on Thursday after the Dow and Nasdaq hit record highs earlier in the session as investors focused on U.S. President-elect Joe Biden’s pandemic aid proposal, while the U.S. dollar weakened.

MSCI’s all-country world index was last trading in barely positive territory but was well off its record-high levels of the session.

The New York Times, citing people familiar with the plans, reported that Biden is expected on Thursday to unveil a $1.9 trillion spending package.

Stocks began to pare gains and the dollar drifted lower after Federal Reserve Chair Jerome Powell struck a dovish tone in comments at a virtual symposium with Princeton University.

Powell said the U.S. central bank is not raising interest rates anytime soon and rejected suggestions the Fed might start reducing its bond purchases in the near term.

After recent strong U.S. stock market gains, equity investors are looking for signals that could mean further support for the market, said Paul Nolte, portfolio manager at Kingsview Investment Management in Chicago.

“We had a pretty good rally in the fourth quarter and a decent rally so far this year,” he said. “Markets are in a wait-and-see mode.”

Friday marks the start of fourth-quarter earnings for S&P 500 companies, with results from JPMorgan Chase and other banks due.

Investors are “waiting to hear commentary from companies on how things were looking in the fourth quarter and how things will look in the first quarter, especially given the not-so-great economic backdrop,” Nolte said.

The Dow Jones Industrial Average fell 68.95 points, or 0.22%, to 30,991.52, the S&P 500 lost 14.3 points, or 0.38%, to 3,795.54 and the Nasdaq Composite dropped 16.31 points, or 0.12%, to 13,112.64.

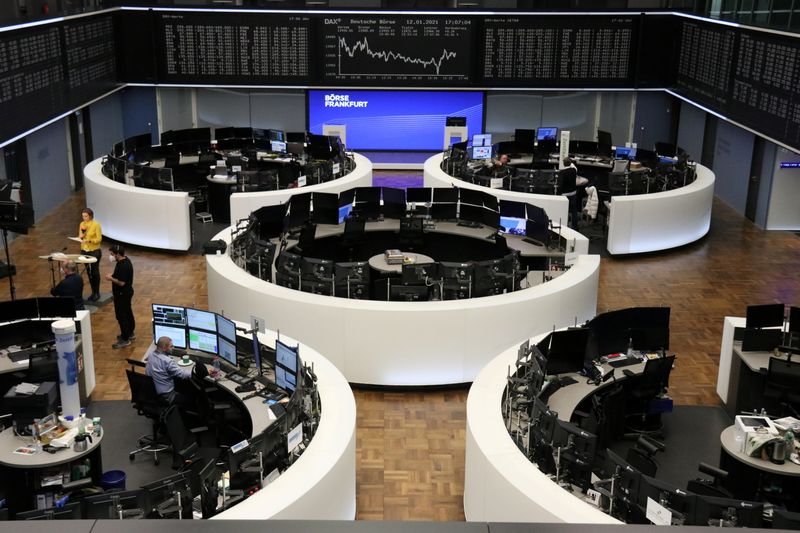

European shares gained for a third straight session. The pan-European STOXX 600 index rose 0.72% and MSCI’s gauge of stocks across the globe gained 0.01%.

The dollar index fell 0.071%, with the euro down 0.02% to $1.2154.

Bitcoin held gains after a slide of nearly $12,000 from last week’s record high of $42,000. It rose about 5.7% to $39,536 on Thursday, after hitting a session high above $40,000.

Treasury yields edged higher in anticipation of the new stimulus package, but a jump in U.S. jobless claims put a damper on immediate expectations of economic growth.

Benchmark 10-year Treasury notes last fell 12/32 in price to yield 1.1292%, from 1.088% late on Wednesday.

Oil prices edged higher, boosted by a weak dollar and bullish signals from Chinese import data. Brent crude oil futures rose 36 cents, or 0.6%, to settle at $56.42 a barrel. U.S. crude ended 66 cents, or 1.3%, higher at $53.57.

Spot gold added 0.2% to $1,847.11 an ounce.

(Additional reporting by Gertrude Chavez-Dreyfuss, Herbert Lash and Devika Krishna Kumar in New York; Editing by Angus MacSwan, Steve Orlofsky and Dan Grebler)