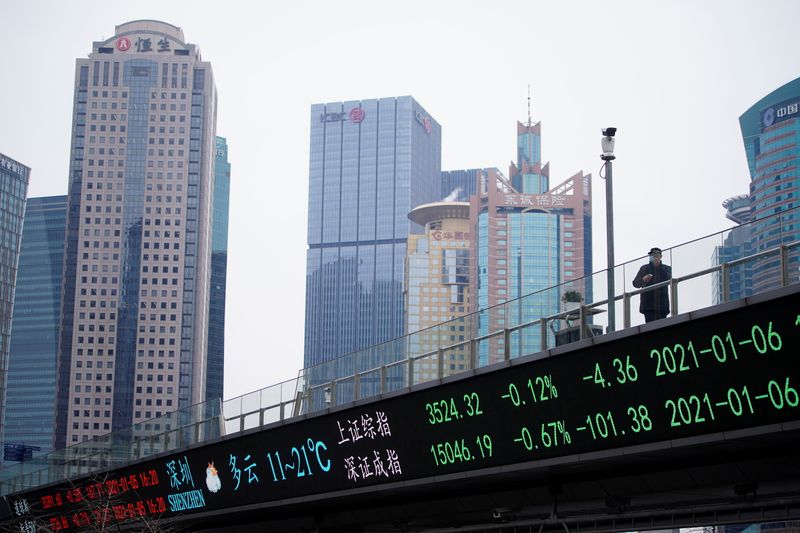

NEW YORK (Reuters) -Global stock indexes were mostly higher and 10-year U.S. Treasury yields topped 1% for the first time since March but stocks ended off session highs after hundreds of protesters stormed the U.S. Capitol and sought to force Congress to undo President Donald Trump’s election loss.

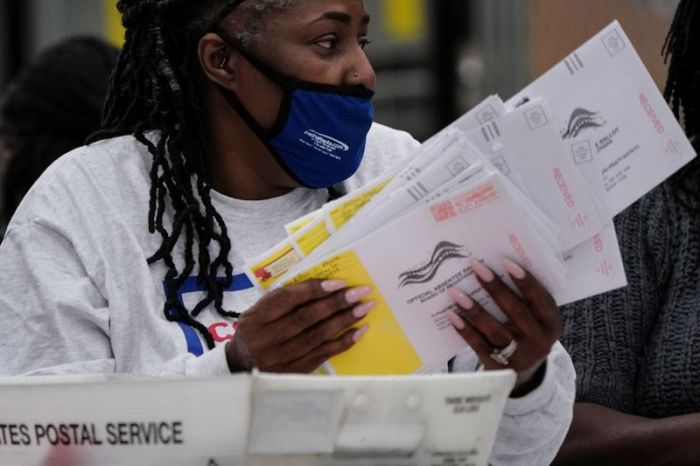

The gains followed results from Tuesday’s runoff elections in Georgia that by late in the day gave Democrats control of the U.S. Senate. The Dow and S&P 500 ended up and the Nasdaq finished lower.

The sweep of the two Senate seats up for grabs in Georgia gave the Democratic Party control of both houses of Congress and boosted the prospects for President-elect Joe Biden’s legislative agenda.

Investors snapped up financial and industrial stocks on bets that a Democrat-controlled Congress would lead to more fiscal stimulus and infrastructure spending.

Technology shares fell amid concern over increased regulatory scrutiny of technology mega-caps under Democratic control.

“What investors are trying to figure out is how quickly the Democrats would be able to introduce their tax agenda if they take control of the Senate, and would they be more likely to act on regulation on big tech,” said Quincy Krosby, chief market strategist at Prudential Financial in Newark, New Jersey.

She called the protests in Washington “the manifestation of a very divided Republican Party,” and added she was confident the authorities would soon get them under control.

The Dow Jones Industrial Average rose 437.8 points, or 1.44%, to 30,829.4, the S&P 500 gained 21.28 points, or 0.57%, to 3,748.14 and the Nasdaq Composite dropped 78.17 points, or 0.61%, to 12,740.79.

The pan-European STOXX 600 index rose 1.36% and MSCI’s gauge of stocks across the globe gained 0.45%.

Bond yields rose with prospects increasing for further economic stimulus measures. Benchmark 10-year notes last fell 24/32 in price to yield 1.0355%, from 0.955% late on Tuesday.

In the currency market, the dollar was little changed after sinking to its lowest level in nearly three years.

The dollar index fell 0.086%, with the euro up 0.27% to $1.2327.

Oil prices rose to their highest levels since February after Saudi Arabia announced a big voluntary production cut and on a fall in U.S. crude inventories. Brent crude settled up 1.3%, at $54.30 a barrel, while U.S. crude futures settled 1.4% higher at $50.63.

Spot gold dropped 1.6% to $1,918.06 an ounce.

(Reporting by Caroline Valetkevitch in New York; additional reporting by Karen Pierog in Chicago and Jessica Resnick-Ault in New York; Editing by Alex Richardson, Alison Williams, Hugh Lawson and Sonya Hepinstall)