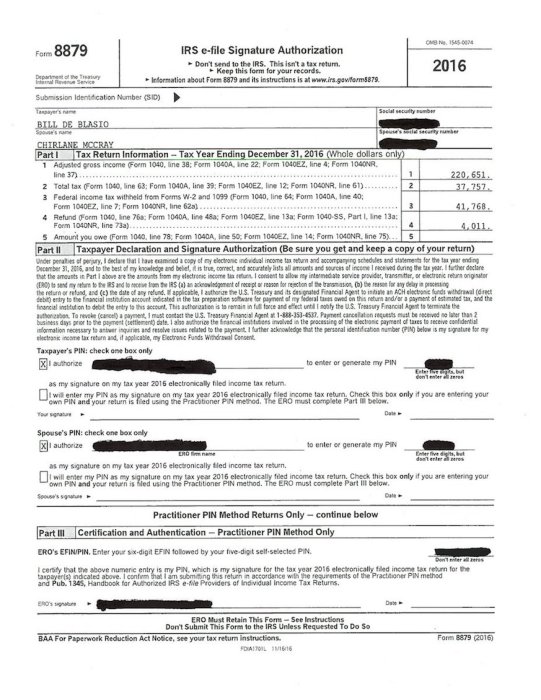

Aside from accountants and perhaps a few sadistic IRS agents, no one in this country seems overly fond of the federal tax code. It’s ridiculously complicated. It’s laced with loopholes. And for many families, collecting receipts, filling out forms and sifting through the maze of rules to file each April is like being beaten with a knotted rope.

So it’s no wonder both major political parties have long chattered about reworking tax laws. And now comes the Trump administration’s swing at that elusive piñata. The president wants a lower corporate tax rate, a much simpler tax code and – if all goes as hoped – a reinvigorated business climate from which everyone benefits. At least that’s the theory. Will he get it? Good question.

The Republicans – his own party – are at least tentatively on Trump’s side. They would like to give business a boost, but they worry if the new plan is too favorable for the upper crust, it could look like a giveaway program for the wealthy. That could inflame middle class voters against the GOP even as next year’s midterm election looms. Complicating things further is the fact that the White House has been exceedingly thin on the details of what it wants.

Meanwhile, Democrats have been fearful of Trump’s pro-business agenda from the get-go. And while they too like the idea of tax reform in the abstract, the reality of a Republican plan could easily bring far too many poison pills for the Dems to swallow. On top of which, few want to be seen helping Trump in any way while their base is railing against him. The president is inviting party leaders from both sides to break bread and discuss the matter. He is preparing for a whirlwind tour to whip up popular support. His surrogates are selling the idea as if it is a done deal. And maybe all that will work.

But make no mistake: Getting tax reform passed in this town has been a long shot for a long time, and starting late in the year with an ill-defined plan and an increasingly unpopular president doesn’t seem like the most promising way to improve the odds.