When are the first moments that you really start to get a handle on your finances as an adult? Is it after those sobering moments when you’ve noticed that you need to crawl out of the piles of debt you’ve accrued in order to earn a college degree or from loans you’ve taken out to get your small business off of the ground. The truth is, the earlier you have an understanding of your personal debt and finances the better you will be. College students are now officially able to fill out 2018-2019 FAFSA applications to find out what kind of financial aid they can receive and cut down on any student loans they would normally have to apply for to pay for school. Kevin McMullen, the founder and president of the college admissions counselling organization Collegewise, provided us with some helpful tips on how to get as much aid as possible towards your college tuition.

2018-2019 FAFSA applications: How to get the most aid available

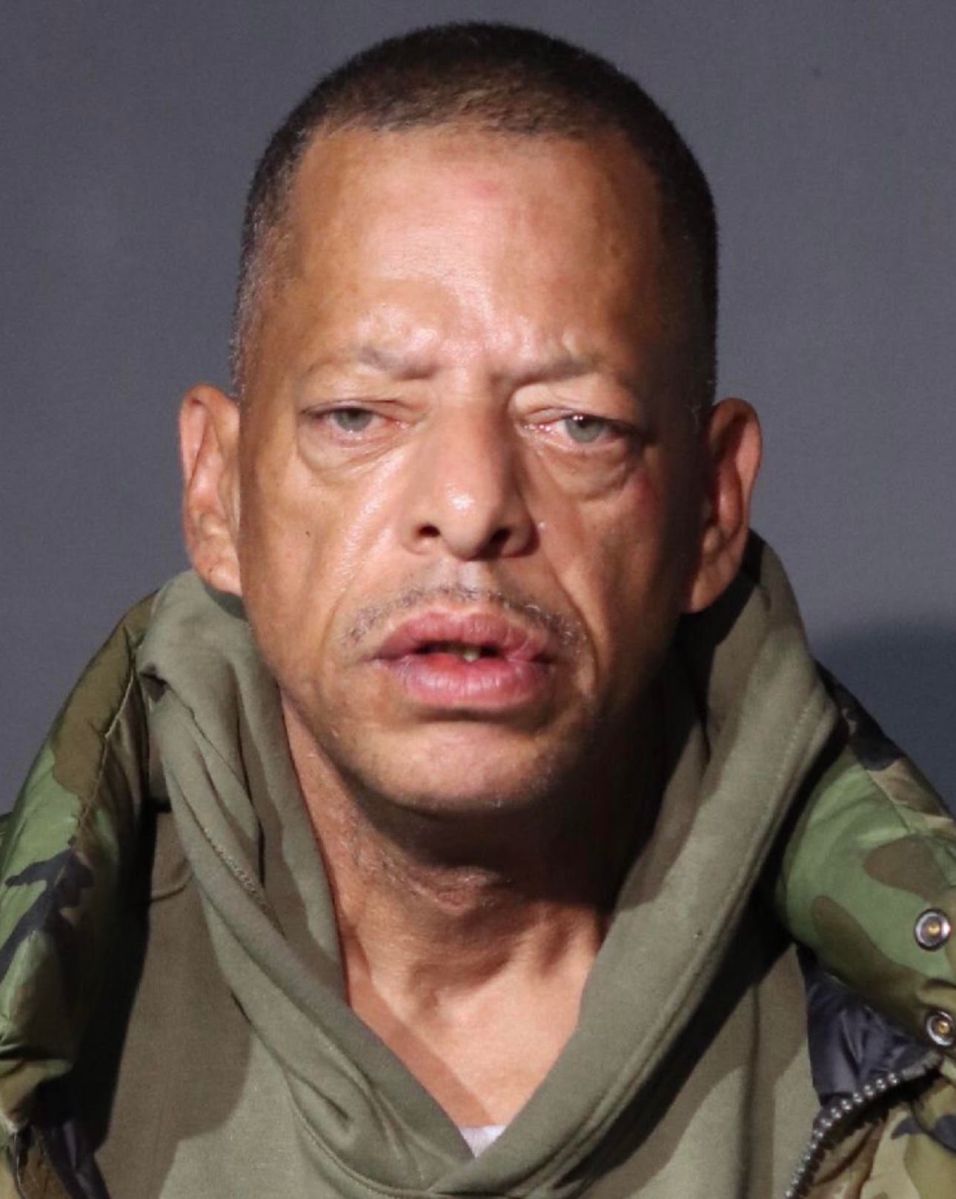

Photo Credit: iStock

Understand where financial aid comes from

One thing that many college students don’t understand is that the government provides students with thousands of dollars every year towards their financial aid. What is frustrating about this, is that a lot of this money goes unused from students not taking advantage of this or filling out their 2018-2019 FAFSA applications the right way. But the key to getting this money is convincing the federal government to invest this kind of money towards your degree. Even if you do not apply for the need-based aid the government can provide, they may help you out a little bit for your efforts.

“The absolute best strategy you can employ to get more financial aid dollars in your pocket is to apply to a balanced list of colleges including schools that are safe bets for you academically — and thus more likely to give you merit-based aid — and ones that have generous need-based aid programs,” explains McMullen in his report Seven Tips to Get Thousands in Financial Aid.

Research the requirements from your schools of choice

There is a reason that many students have what they call “safety schools”. It is because these are schools that you know that you will have no trouble getting into based on what their required GPA or SAT scores are. By researching these requirements of what the rest of the applicant pool will look like for these schools towards the end of your time at high school, you will have a good idea of what kind of help you will get with financial aid as you fill out your 2018-2019 FAFSA applications.

“Starting junior year, develop a sense of where you fall academically within the applicant pool at your colleges of choice,” explains McMullen . “Look up and record the average score ranges and GPAs of the incoming class at all of the colleges you’re interested in. Don’t know where to look for these data points? Every college in the county has a profile on the College Board’s website that includes average score ranges and GPAs.”

2018-2019 FAFSA application deadlines

The final deadline for 2018-2019 FAFSA applications is 12 a.m. on June 30, 2019. For more helpful tips on filling out your 2018-2019 FAFSA applications and lowering your college tuition, head over to Collegewise.com.