(Reuters) – Twitter Inc’s stock tumbled over 6% on Monday after its move to permanently suspend U.S. President Donald Trump’s widely-followed account spurred concern among investors over the future regulation of social networks.

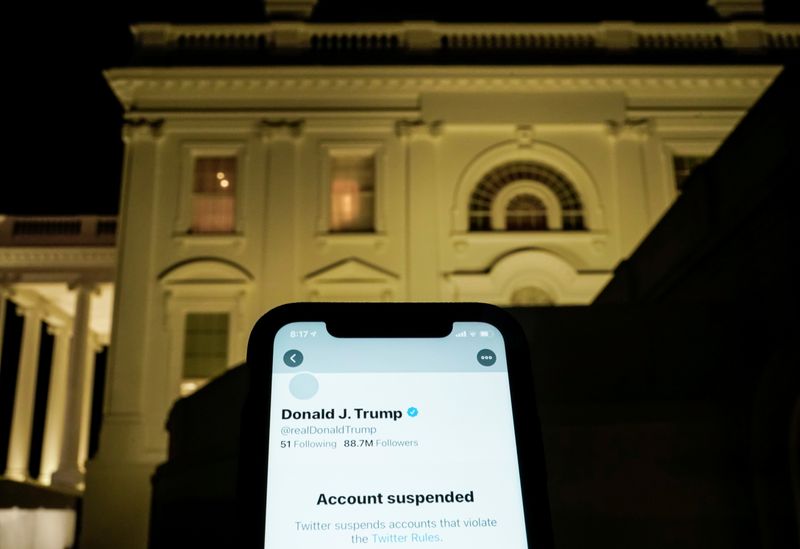

The San Francisco-based social media company said on Friday its suspension of Trump’s account, which had 88 million followers, was due to the risk of further violence following the storming of the U.S. Capitol last week.

The move drew criticism from some Republicans for quelling the president’s right to free speech, while European Union Commissioner Thierry Breton said the past week’s events likely heralded a new era of heavier official control.

German Chancellor Angela Merkel, whose relations with Trump have been frosty, criticized Twitter’s ban and warned through a spokesman that legislators, not private companies, should decide on potential curbs to free expression.

The attention drawn to Twitter increased investors’ worries that it could be more exposed to regulation than its bigger rivals Facebook Inc or Google and YouTube-owner Alphabet.

Other social media platforms, including Facebook, have issued similar bans on Trump, but Monday’s fall of as much as 12% in Twitter’s stock was much deeper than for any of its peers. Facebook was last down almost 4% and Alphabet lost 2%.

Speaking during the Reuters Next conference, Facebook’s operations chief Sheryl Sandberg said the world’s largest social network had no plans to lift its block on Trump’s accounts.

BIG TECH POWER

Friday’s move, accompanied by suspensions for some of Trump’s supporters, was the first time Twitter had banned a head of state, and Republican lawmakers denounced its decision as an attempt to stifle conservative voices.

Apple Inc, Alphabet and Amazon.com Inc also suspended Parler, a social network favored by many Trump supporters, from their app stores and Web-hosting services, effectively making the service inaccessible.

“These moves, whether you consider them justified or not, could well see them lose further users if they become seen as arbiters of what is considered politically correct or acceptable,” said Michael Hewson, chief analyst at CMC Markets UK.

(GRAPHIC: Twitter, FAANG stocks outperfrom S&P 500 in 2020 – https://fingfx.thomsonreuters.com/gfx/mkt/dgkvlqrbapb/TWTR.PNG)

U.S. President-elect Joe Biden has been quoted as criticizing the “overwhelming arrogance” of the tech sector’s leaders and analysts expect more legal moves to curb their power over the next four years.

EU Commissioner Breton said the change in regulation may prove comparable to the global crackdown on terrorism after the attacks of Sept. 11, 2001.

“The fact that a CEO can pull the plug on POTUS’s loudspeaker without any checks and balances is perplexing,” he wrote in a column for Politico.

“It is not only confirmation of the power of these platforms, but it also displays deep weaknesses in the way our society is organized in the digital space.”

(Reporting by Ambar Warrick and Sruthi Shankar in Bengaluru; Additional reporting by Subrat Patnaik in Bengaluru and Thyagaraju Adinarayan, Julien Ponthus in London and Noel Randewich in San Francisco; Editing by Rachel Armstrong, Kirsten Donovan, Arun Koyyur and Marguerita Choy)