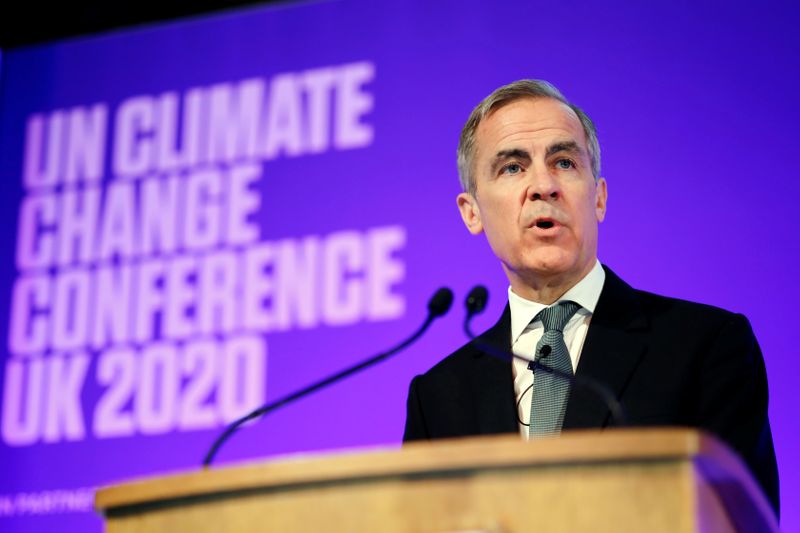

LONDON/BOSTON (Reuters) – U.N. climate envoy Mark Carney on Monday backed a push by investors to force companies to submit their climate change strategies to annual shareholder votes, saying such a mechanism could improve oversight of pledges to slash greenhouse gas emissions.

Carney, who took a U.N. climate finance role after stepping down as Bank of England governor in March, said investors could have an automatic advisory vote on a company’s climate plans, in the same way they are involved in pay discussions.

“Rather than have authorities be overly prescriptive on plans, it may be desirable to have investors have a say on transition,” Carney told the start of a three-day climate conference in London called Green Horizon.

“This would establish a critical link between responsibility, accountability and sustainability,” he added.

U.N. Secretary-General Antonio Guterres, who has made climate change a signature issue of his tenure, also urged in a video message to the conference that investors push companies harder by “systematically supporting climate resolutions”.

Last month, Spanish airports operator Aena <AENA.MC> became the first company to give shareholders an annual vote on its climate plans following pressure from billionaire investor Chris Hohn, founder of the TCI activist hedge fund.

Shareholders backed Aena’s steps, which include ensuring that airports in its network be energy self-sufficient – largely using solar – and carbon-neutral by 2026.

“Such votes should be automatically required,” said Paul Simpson, chief executive of nonprofit climate risk disclosure group CDP.

Currently investors’ leverage on climate issues comes via their votes on corporate directors. JPMorgan Chase & Co <JPM.N> for instance, this year replaced its lead independent director, a former Exxon Mobil <XOM.N> CEO, after pressure from activists.

Some asset managers have been less than enthusiastic about supporting climate resolutions, saying that poorly designed proposals could harm companies and the long-term interests of the clients whose money they manage.

For example, studies have found that New York-based BlackRock <BLK.N>, the world’s largest asset manager, supported climate-related shareholder resolutions around 10% of the time this year, about the same as in 2019. Other asset managers have been more supportive of the resolutions, notably the asset-management arm of JPMorgan <JPM.N>.

(Additional reporting by Ross Kerber in Boston; Editing by Andrew Heavens, Barbara Lewis and Dan Grebler)