(Reuters) – U.S. companies are scrambling to boost production of coronavirus tests increasingly in short supply as COVID-19 cases soar and schools and employers revive surveillance programs that will require tens of millions of tests, according to industry executives and state health officials.

Test manufacturers including Abbott Laboratories, Becton Dickinson and Co, and Quidel Corp in recent months scaled back production of rapid COVID-19 tests, which can produce results on-site in minutes, as well as test kits that are sent to laboratories for analysis. The move followed a nearly 90% decline in testing and a similarly large drop in COVID-19 cases in the United States.

Abbott in June shut down two production lines in Maine and closed a manufacturing plant in Illinois. Around the same time, Quidel shifted production away from COVID-19 tests. Becton Dickinson had also scaled back production in recent months.

Now, with the Delta variant pushing U.S. COVID-19 cases well above 100,000 per day, test makers are working to quickly reverse course, industry executives and state officials told Reuters.

“We’re hiring people and turning on parts of our manufacturing network that were idled or slowed when guidance changed and demand plunged,” Abbott said in a statement.

However, testmakers including Abbott and Becton Dickinson cautioned that there may be supply constraints in the near term.

“With the rise of cases from the Delta variant… there is currently some tightness in supply as manufacturers ramp back up,” said Troy Kirkpatrick, a spokesperson for Becton Dickinson, adding that the company expects inventory levels “will normalize over the next couple of weeks.”

Demand for COVID-19 tests has been largely driven by healthcare providers, employers and schools, he added.

Supplies could tighten even further as more state governments and private employers demand staff either get vaccinated or agree to regular testing. Pfizer Inc and Goldman Sachs are among major employers requiring staff to be regularly tested.

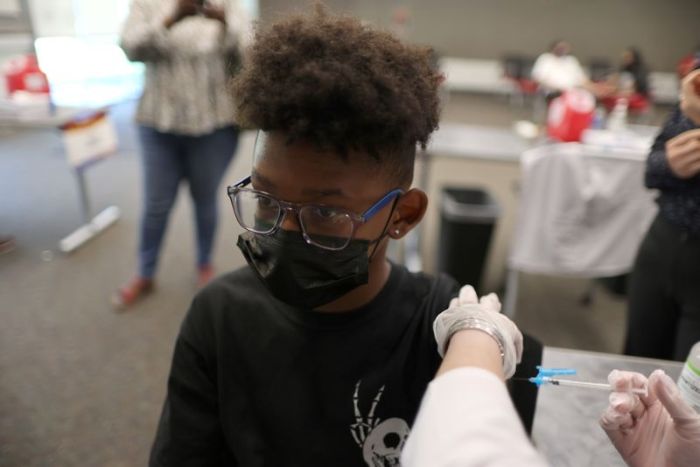

Testing in schools is a top priority for federal and state officials as a minority of the roughly 70 million school-age U.S. children have been vaccinated. Those under 12 are not yet eligible for the shots.

Demand for diagnostic tests has surged nearly six-fold in the past two months, from around 250,000 per day in early July to nearly 1.5 million in mid-August, according to U.S. federal data. The data only tracks diagnostic tests that are run in laboratories.

That demand is only expected to grow.

More than half a dozen states, including California, Delaware, and South Carolina, have set up comprehensive surveillance testing programs for their public K-12 schools, while Pennsylvania and Arkansas are among at least a dozen other states developing similar plans. Even in states without such plans, many local school districts are rolling out surveillance programs.

Ysleta Independent School District in El Paso, Texas, expects to need around 40,000 Abbott rapid tests per month to monitor students for COVID-19, said Lynly Leeper, the district’s chief financial and operational officer.

Her school district had been planning to shut down its testing program until the Delta variant sent cases soaring in the state in recent weeks.

SUPPLY CHAIN CONCERNS

Delaware, which was among the first to roll out a comprehensive surveillance testing program in July, has already begun to see some test shortages, said Dr. Rick Pescatore, an associate medical director in the state’s public health agency.

The surge in test demand has sounded alarms among federal officials, who are “concerned that people are going to start shutting down our supply chain,” limiting the flexibility to respond to a spike in cases, said Quidel Chief Executive Douglas Bryant told Reuters.

The recent increase in surveillance testing “really stresses the supply chain,” said Dana Lerman, medical director at The COVID Consultants, a physicians group that provides COVID-19 testing and advisory services. Her organization has seen demand for rapid tests increase 200% since June.

Even if testmakers are able to keep up with rising demand from U.S. schools, states will still face challenges covering the expense of widespread testing, which experts say will cost the average school district at least $1 million each year.

Ysleta in El Paso said it expects it will cost around $3 million to safely test its students this school year, and is relying on Texas to provide it with funds.

The Biden administration granted $10 billion to help states developing COVID-19 testing programs. Experts said the sum is far short of what states will need to cover testing for the full school year.

“More federal funding will be necessary,” said Dr. Antonia Sepulveda, president of the Association of Molecular Pathology that represents diagnostic testing laboratories, “for institutions to continue comprehensive testing programs.”

(Reporting by Carl O’Donnell; Editing by Michele Gershberg, Caroline Humer and Bill Berkrot)