WASHINGTON (Reuters) – Top U.S. officials have for now put aside a proposal for an alliance with Saudi Arabia to manage the global oil market, according to three sources with knowledge of the matter, an idea one of them said came from White House national security advisers.

That the concept was even considered at high levels reflects both the depth of the crisis facing the global oil industry as well as its growing importance to the U.S. economy. A few weeks ago, proposals for Washington to work together with oil producers to curb supply to the global market would have been dismissed for violating U.S. antitrust laws.

But prices for oil <LCOc1> have slumped to an 18-year low because of the twin hits of the coronavirus pandemic slashing energy demand and a price war between top producers Saudi Arabia and Russia, threatening higher-cost U.S. and global drillers with bankruptcy.

The idea of a U.S.-Saudi alternative to the Organization of the Petroleum Exporting Countries, of which Saudi Arabia is the de facto leader, “has been floated but not at the stage of something that is being seriously considered,” said one of the sources, who all spoke on condition of anonymity.

The two other sources said U.S. Secretary of State Mike Pompeo and Energy Secretary Dan Brouillette discussed the alliance idea with President Donald Trump’s national security adviser Robert O’Brien, but that nothing was decided.

The National Security Council at the White House had asked the Energy Department to draft policy points before the possibility of a U.S.-Saudi alliance on oil was discussed, one source said.

It was unclear which policy points were discussed. The Wall Street Journal reported in March that an alliance could involve supporting oil prices through use of national reserves, economic stimulus and offering indemnity to Saudi Arabia for oil market moves, points that no officials would confirm to Reuters.

The Energy Department said Brouillette and others at his department are engaged with other U.S. officials, Saudi Arabia and other allies about oil markets, but would not confirm the Reuters or Wall Street Journal reporting.

Brouillette, who is close to Pompeo, told Bloomberg TV last week an alliance with Riyadh is one of “many, many ideas” being discussed, but that no decisions have been made.

Trump has taken a dim view of OPEC in the past, calling it a monopoly that pushes oil prices “artificially high” by cutting production, and often urged it to raise output.

Still, Trump has nurtured the relationship with Saudi Arabia, emphasizing it has agreed to buy hundreds of billions of dollars in U.S. weapons, and helped make up for lost shipments of crude from OPEC-member Iran after he reimposed sanctions in 2018.

The United States was for decades the world’s largest net importer of petroleum but the shale boom has transformed it into the world’s biggest producer of oil. That has given Trump freedom to take a different approach to the Middle East than predecessors who were more dependent on its oil imports.

‘DIFFERENT PLANET’

It is more difficult for the U.S. government to coordinate a production cut with another country because American oil companies are not state owned. But as Washington scrambles to limit the price shock that threatens to bankrupt companies and lay off thousands of oil and gas workers heading into the November election, it is likely that the alliance conversation will persist.

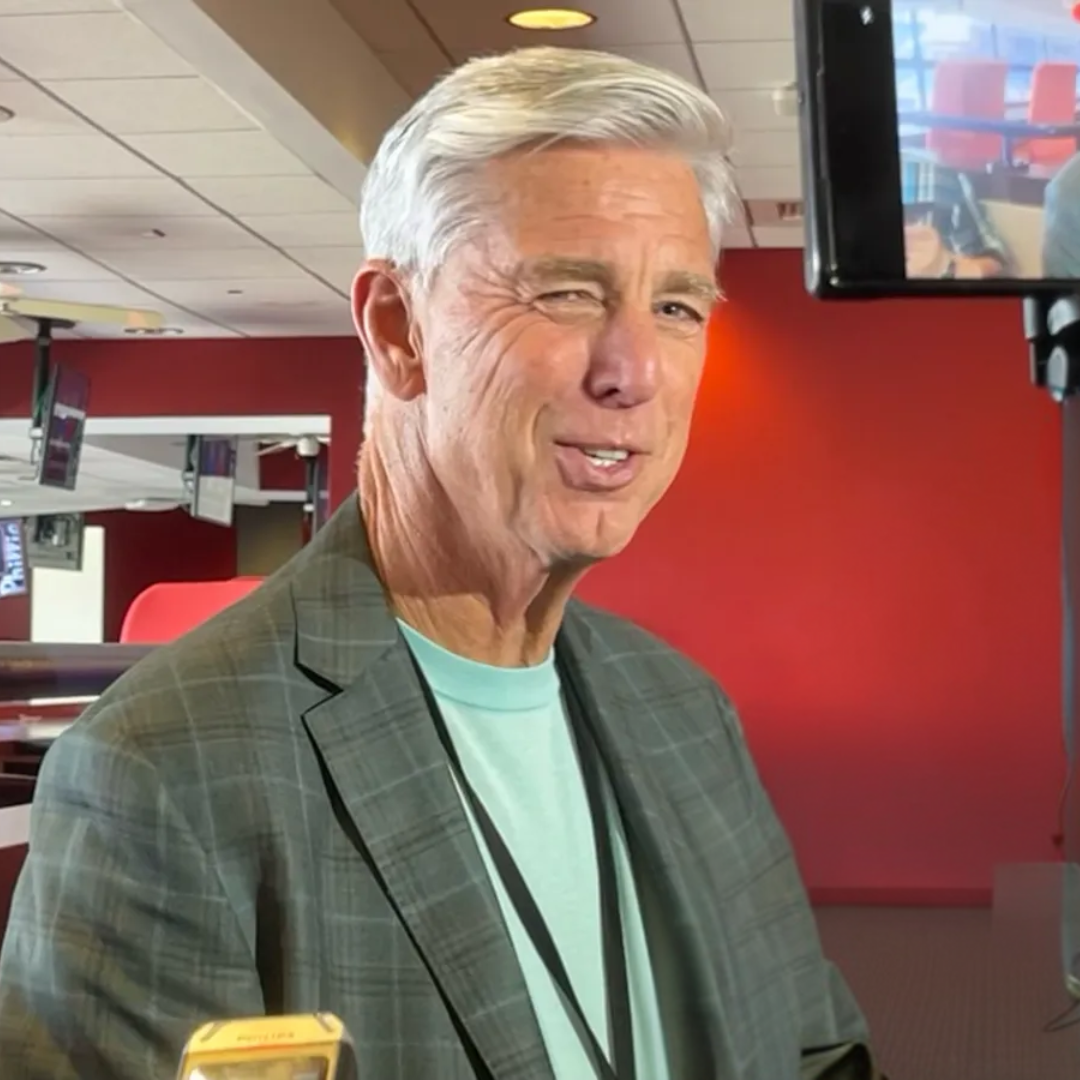

“It’s almost like we are on a different planet than we were a month ago,” said Daniel Yergin, the vice chairman of IHS Markit, who sometimes advises U.S. officials on energy. “It’s forcing everybody to rethink what’s possible, what’s not possible.”

There have also been signs that the oil and gas regulator in Texas, a top oil producer, could be open to OPEC-style market management.

Texas Railroad Commissioner Ryan Sitton said last week he spoke with OPEC Secretary General Mohammad Barkindo about a deal to ensure economic stability, but was not yet advocating for cuts.

Meanwhile, diplomatic efforts to lift the oil market continue. The Energy Department will send Victoria Coates, a former White House Middle East adviser, to Saudi Arabia as a special envoy.

Trump and Russian President Vladimir Putin spoke on Monday and directed their energy ministers to speak – an unprecedented move that further underscores the urgency both countries feel over low oil prices.

Saudi Arabia showed no signs of letting up on boosting production to win market share, aiming to export 10.6 million barrels per day because of lower domestic consumption. Saudi Aramco has asked energy service firms to support plans to produce to its maximum capacity of 12 million bpd from April 1 “for the foreseeable future”, a Saudi oil industry source told Reuters on Tuesday.

DEFENSE RELATIONSHIP

While Trump administration officials talk gingerly about the relationship with Saudi Arabia, U.S. lawmakers have taken a tougher approach – showing the kinds of legislative threats facing the kingdom if it doesn’t respond to the administration.

A bill introduced this month by Republican Senators Dan Sullivan and Kevin Cramer would remove U.S. troops from the kingdom and relocate them.

The bill is unlikely to get the votes to reach Trump’s desk. But it sent a signal to Saudi’s de facto leader Crown Prince Mohammed bin Salman.

“The United States must seriously reconsider the level of American support – including military support – for such partnerships that fail to support us in turn,” Sullivan said.

A source with knowledge of U.S.-Saudi relations said pressure from Congress is a card the administration could use to convince Saudi Arabia to reduce oil output on its own, obviating any need for a more formal alliance.

(Reporting by Timothy Gardner in Washington, additional reporting by Valerie Volcovici, Steve Holland and Humeyra Pamuk in Washington and Rania El Gamal in Dubai; editing by Grant McCool)