WASHINGTON (Reuters) – The U.S. Treasury Department said it distributed more than $16 billion in expanded Child Tax Credit payments on Wednesday in the final month of a COVID-19 pilot program set to expire as President Joe Biden’s social and climate spending bill languishes in Congress.

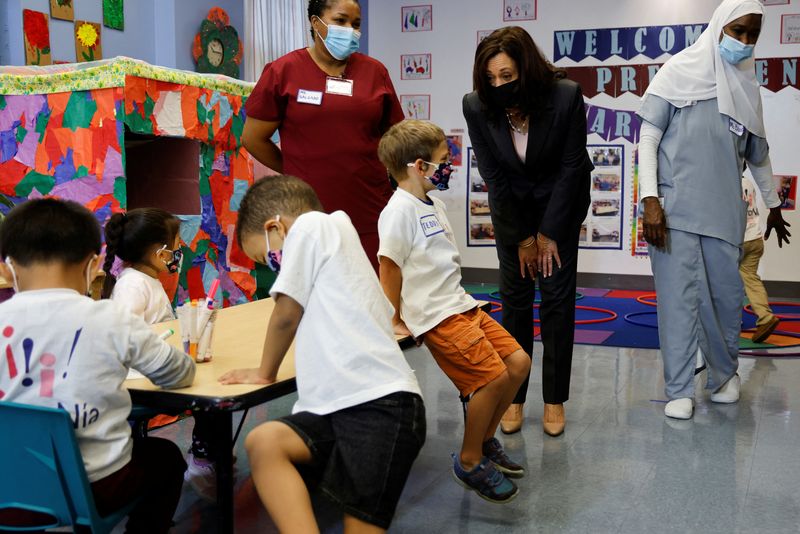

The monthly payments, which began in July, lifted some 3.6 million American children out of poverty in October, according to Columbia University research.

December’s check for $300 per child under age 6 and $250 per child age 6-17, which reached the families of 61 million children, will be the last monthly payment if a proposed extension in the “Build Back Better” legislation is not approved by Congress.

The tax credit is set to revert next year to its prior form: a lump sum that requires Americans to file a tax return to claim it, and a reduction to $2,000 annually per child from up to $3,600 this year. The Treasury in June estimated that families with as many as 2.3 million children did not file tax returns in 2019 or 2020.

Since July, total monthly disbursements came to $93 billion. In August, average Child Tax Credit payments were highest in states that supported former president Donald Trump in the 2020 election.

“The lives of tens of millions of children across the country have improved because families have received tax relief when they need it most,” U.S. Treasury Secretary Janet Yellen said in a statement.

As Democrats in Congress struggled to find a path forward on Biden’s $1.75 trillion domestic investment bill, a person familiar with negotiations said that moderate Democratic Senator Joe Manchin was objecting to extending the expanded Child Tax Credit in the legislation.

(Reporting by David Lawder; Editing by Heather Timmons, David Gregorio and Christian Schmollinger)