WASHINGTON (Reuters) – The number of Americans seeking jobless benefits fell for an eighth straight week last week, likely as some people returned to work, but claims remained at astonishingly high levels, suggesting it could take the economy a while to rebound as businesses reopen.

The Labor Department’s weekly jobless claims report on Thursday, the most timely data on the economy’s health, also showed a decline in the number of people receiving unemployment checks in mid-May. The data, however, excludes gig workers and others collecting benefits under a federal government program.

These workers do not qualify for the regular state unemployment insurance. The various programs, different reporting periods and protocols at state unemployment offices make it hard to get a clear pulse on the labor market.

Economists said the government’s Paycheck Protection Program, part of a historic fiscal package worth nearly $3 trillion, which offered businesses loans that could be partially forgiven if they were used for employee salaries, was also creating confusion.

“We are entering the confusion stage for the employment and unemployment numbers,” said Joel Naroff, chief economist at Naroff Economics in Holland, Pennsylvania. “Reopening of the economy is taking people from government payrolls to private sector payrolls, which is good. But the PPP is creating problems with understanding what exactly is happening.”

Initial claims for state unemployment benefits fell 323,000 to a seasonally adjusted 2.123 million for the week ended May 23, the Labor Department said. Claims have declined steadily since hitting a record 6.867 million in late March, but have not registered below 2 million since mid-March.

Economists polled by Reuters had forecast initial claims falling to 2.1 million in the latest week. Layoffs persist in the insurance, educational services, public administration, transportation and warehousing, agriculture, construction, manufacturing and retail trade industries.

The astonishingly high level of claims, nearly three months after the shuttering of non-essential businesses to control the spread of COVID-19, points to a long recovery for the economy.

That was underscored by other data from the Commerce Department on Thursday showing business spending on equipment plummeting in April and the economy contracting at a much steeper 5.0% annualized rate in the first quarter instead of the previously estimated 4.8% pace.

Data in hand, including on the housing market, manufacturing and consumer spending has left economists expecting gross domestic product could drop in the second quarter at as much as a 40% rate, the worst since the Great Depression.

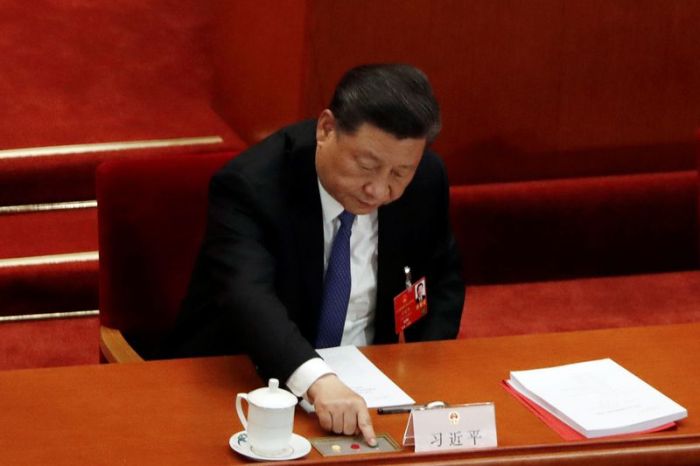

Stocks on Wall Street were trading higher, but simmering tensions between the United States and China kept investors on edge. The dollar eased against a basket of currencies. U.S. Treasury prices dipped.

LONG-TERM DAMAGE

A record 40.767 million people filed claims since March 21.

“We think these filings in the 10 weeks since the mid-March coronavirus pandemic lockdown tells the true story of the wreckage out there in the country and the enormous long-term damage done to the economy,” said Chris Rupkey, chief economist at MUFG in New York.

The number of people still receiving unemployment benefits after an initial week of aid dropped 3.860 million to 21.052 million in the week ending May 16. The so-called continuing claims number is reported with a week lag.

Economists cautioned against reading too much into the sharp decline, noting that some states required residents to file for benefits on a bi-weekly basis, which they said was injecting volatility into the data. The drop in continuing claims was concentrated in Florida, California, Washington State and Ohio.

“We doubt this is due to hiring and may reflect more the fact the continuing claims numbers are state benefits and don’t include the people claiming the Pandemic Unemployment Assistance,” said James Knightley, chief international economist at ING in New York.

The Pandemic Unemployment Assistance (PUA) program is the federal government initiative that pays unemployment checks to gig workers and many others for coronavirus-related job and income losses.

These workers do not qualify for regular state unemployment insurance and are not included in both the weekly jobless claims and continuing claims figures. There were 1.193 million claims submitted last week under the PUA program, on top of the 7.793 million applications processed in the week ending May 9.

Including gig workers and other claimants, a staggering 31 million people were receiving benefits under all programs in early May.

The continuing claims data covered the period during which the government surveyed households for May’s unemployment rate.

Continuing claims increased roughly by 3 million between the April and May survey periods, suggesting a rise in the jobless rate from a post-World War Two record of 14.7% last month.

(Reporting by Lucia Mutikani; Editing by Chizu Nomiyama and Andrea Ricci)