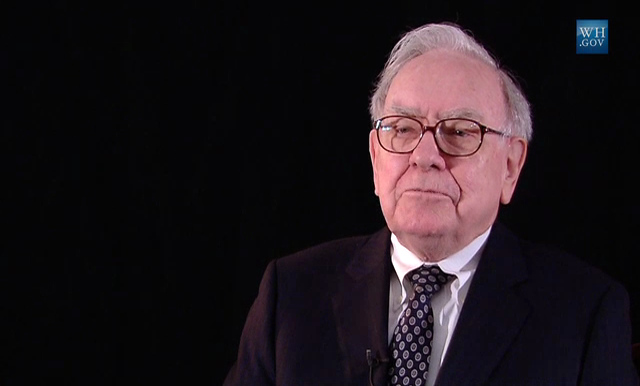

Warren Buffet, the second-richest man in the world, is calling foul on President Donald Trump’s plan to do away with the estate tax on the wealthiest Americans.

The estate tax is levied on property as it passes ownership from a dead person onto their heirs on estates worth more than $5.5 million (double for couples) and Buffet said he thinks it would be a “terrible mistake” to get rid of it.

Buffet, the billionaire investor who heads Berkshire Hathaway, is worth about $75 billion and he spelled out how getting rid of the estate tax would affect wealthy Americans like him.

“If they pass the bill they’re talking about, I could leave $75 billion to a bunch of children and grandchildren and great-grandchildren. And if I left it to 35 of them, they’d each have a couple billion dollars,” Buffett said.

“Is that a great way to allocate resources in the United States?” he asked rhetorically.

Eliminating the so-called “death tax” could lead to dynasty building as the richest Americans continue to hold on to the majority of the wealth in the nation — the 20 wealthiest people in America now own more than half of the nation’s wealth, which Buffet said is a poor allocation of resources.

“I sure don’t think that’s good for a society where there’s a ton of inequality to start with,” he said on CNBC’s “Squawk Box.”

Buffet argued the estate tax doesn’t actually affect most Americans and serves a purpose to break up and redistribute wealth in the United States.

“It’s not a death tax,” Buffet said. “There are going to be 2.6 million people who die this year in the United States and there will be about 5,000 tax returns of estates that they tax.”

Getting rid of the 40 percent estate tax has been a hot button among Republicans for years and was included in Trump’s tax plan that was unveiled last week — a plan some claim was designed to pad the pockets of the rich. The reform measure also recommends cutting corporate taxes and simplifying the tax code.